Milan Pandey

President of TUIG, Majoring in Finance

Aleksandr Olshansky

Portfolio Manager of TUIG, Majoring in Finance

Jordan Le

Director of Communications of TUIG, Majoring in Accounting and Finance

Daniel Morales

Assistant Portfolio Manager of TUIG, Majoring in Finance

Nicholas Norman

Majoring in Finance

Introduction

The Towson University Investment Group (TUIG) surveyed the extent to which Towson University students know about investing and decision making. We started our survey with gathering data from our target demographic audience about general investing knowledge, followed by investment decisions and risk tolerance. In total, we had 38 respondents. We sought to evaluate students’ knowledge of investment decisions, risk management, time-horizon, and used major and college- specific segmentation of respondents to segment our data. With the existing macroeconomic backdrop currently stands – new investing precedents, an influx in new investors, and new economic boundaries, the survey gave us good insight into how college students are proceeding with their decision-making. Key questions in the survey included: What are your financial priorities after graduation? With $100,000 to invest, how would you allocate your money? What percentage of your portfolio would you allocate to cash? If you were to invest in equities, what sectors would you focus on?

Towson University is composed of the following colleges: College of Business & Economics (CBE), College of Health Professions (CHP), Jess & Mildred Fisher College of Science & Mathematics (FCSM), College of Liberal Arts (CLA), College of Fine Arts & Communication (COFAC), and College of Education (COE).We questioned the students throughout the entire University to involve a variety of answers and conducted the survey in October 2021. The results helped us conclude how Towson University students approach investing with respect to their asset allocation, sector and stock diversification along with their specific risk tolerance and time horizon.

Participant Background

The demographics data from our respondents indicate that 67.6% are male. In terms of ethnic distribution, 56.8% of the respondents were White, 16.2% were Hispanic or Latino, 10.8% for Black or African American, 10.8% for Asian/Pacific Islander, and the remainder being distributed between Middle Eastern and Asian and Black. Again, we saw a more significant skew towards Juniors and Seniors, with 43.2% Juniors and 27% Seniors. As for respondents’ employment, 48.6% are employed for wages either salaried or paid by the hour, 21.6% do not actively work, 10.8% are interning, and 10.8% are out of work but looking for a job. A majority of the survey participants were from the College of Business & Economics, consisting of 22 students from the CBE college, with a majority pursuing a Finance Major. The average GPA for respondents was 3.32, with a range between 2.1 and 3.9.

$100,000 Student Portfolio

TUIG conducted a research survey that asked participating students how they would allocate their money if they had $100,000 and what percentage of their portfolio would you allocate to cash, the time horizon, investment objective, and your risk tolerance. The survey also asked what specific stocks, crypto, and sectors students would invest in. Roughly 75% of student respondents said they would diversify their portfolio into various sectors. This approach aligns with the TUIG portfolio as we aim to allocate in all 11 sectors like the S&P 500 index. The remainder of the students would allocate their money into Growth and Real Estate.

Regarding the cash position within their portfolio, 50% of students would allocate 10-25% to cash, 25% said they would allocate 0-10% cash, and 22.2% of students said they would allocate 25-50% of the cash. Overall, students are more likely to keep a more significant cash position (10-25%) than the TUIG portfolio of 8% due to the high fluctuations in the market and the increase in volatility of asset prices. Students’ responses have shown they are more concerned with long-term investing than short-term; 45.7% of respondents said their time horizon is more than ten years, and 28.6% with a 2-5 year time horizon. This aligns with their overall investment objective of growth (75% of respondents), and 19.4% wanted a source of income. Low-risk and medium risk responses both pulled in 46.2%, with 7.7% voting for high-risk. Students aim for growth in their portfolio, have a long-term horizon, and lower their risk by diversifying in different sectors within the market.

Major Holdings

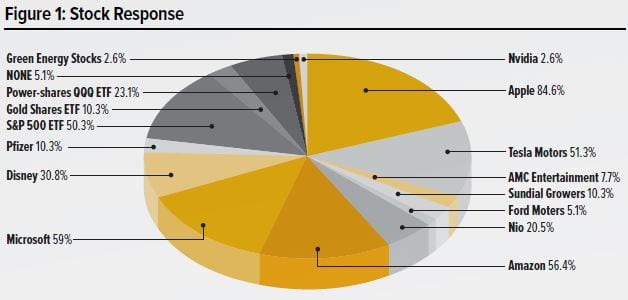

The top 5 holdings from the 2021 survey are Tesla and the S&P 500 ETF ($SPY), coming in with 50% of the participants selecting these stocks, Amazon (55.3%), Microsoft (57.9%), and Apple (84.2%). The most significant differences within the top 5 holdings from this year and last year 2020 would be the absence of Google and Disney and the addition of Tesla and the S&P 500 ETF. This could be because 46.2% of the respondents indicated that they have a lower risk tolerance, and one of the best ways to mitigate risk is by diversifying their money in the S&P 500 ETF. Tesla has also become a new favorite among investors, especially with its recent performance in the stock market and future outlook. Over the past year (October 25, 2020 – October 25, 2021), Tesla has gone up 143.85% from $420.28 to $1024.86 compared to Apple, which has gone up only 29.23% from $115.05 to $148.67, and Disney, which has seen a 38.30% from $124.06 to $171.57.

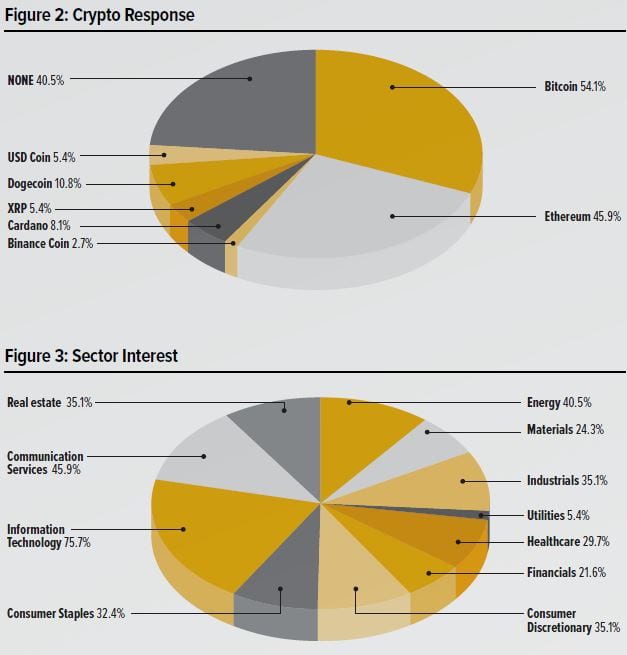

Cryptocurrency In recent years, cryptocurrency has gained popularity within the investment community as a potential area for profit. Bitcoin, the top cryptocurrency, hit a record high of $66,974 on October 20, 2021, thus moving the rest of the crypto market higher because most cryptocurrencies follow the same patterns as Bitcoin. In this year’s survey, we asked the respondents, “if they were to choose to invest in crypto currency, please specify which crypto currency you would invest in?” and the top 5 responses were Bitcoin (52.8%), Ethereum (44.4%), None (41.7%), Cardano (8.3%), and Dogecoin (8.3%). Many investors do not understand cryptocurrency and do not see it as a possible investment. 41.7% of respondents claim they would stick to equities and other investments that they understand better. This could be one of the reasons for such a high response rate to not investing in crypto at all. Those who understand crypto tend to lean on the more prominent cryptocurrencies like Bitcoin and Ethereum, as they are usually the movers of the crypto market.

Many students are risk-averse and chose no investment in crypto in order to preserve capital and have an adequate annual return for their investments given their longer term horizon. The top picks for specific stock holdings are blue-chips and in the S&P 500, which have a historic performance of 10% annually.

Sectors

During 2020 with COVID-19 and the supply chain crisis, many sectors suffered. The Consumer Cyclical sector (Auto Manufacturer, restaurants) was suffering amid the global quarantine. Many people saved money throughout the 2020 recession, and many companies in this industry lost revenue. Another industry that took heavy battering was the Industrial sector (Airline industry). Following the quarantine and foreign and domestic travel restrictions, the Airline Industry stocks saw severe decreases. In February 2020, shares of Delta Air Lines were worth $58.90; In March, shares dropped to $21.35. Investors suffered significant losses, and many investors transitioned to long-term investing.

Following the 2020 market crash, the method of investing changed for many. When Towson University students were asked, “When investing in the stock market, which sectors interest you the most?” We surveyed that most hypothetical investments were dominated by the information technology (75%) and communication services (44.4%) sectors. With information technology being one of the fastest-growing industries and most essential assets in most businesses, many investors are attracted to the potential growth/innovation and low volatility the future holds. During COVID-19, technology saw a benefit from the pandemic. According to Morningstar, “the US Technology index was up 47.5% in 2020.” Many technology investors gained profits through hardship. This sparked interest for many investors. Communication also received significant increases due to the quarantine and heavy reliance on advertising demand on these platforms. Companies such as Facebook and Google did not suffer during COVID-19 compared to others. In conclusion, it can be observed that Towson University students prefer investing in IT and Communication because of the long-term potential in both sectors.

Student Investing Experience and Knowledge

Of our samples, a simple question was asked: do you invest your money? A surprising 60.52% of respondents say they do, while the remaining 34.21% do not, and the last 5.26% possibly support. It indicates that more than half of the respondents are on the right track to retire in the future; starting at an early age puts them ahead of the curve. When asked about their investment experience from no investment experience to expert knowledge, 44.73% are intermediate, 34.21% are beginners, and 21.05% have no experience. Indicating that most participants have an idea of what they are doing and that they are responsible with their money, one can invest money anywhere, but if no knowledge is known about a particular field, losses can occur; this is why many people seek professional guidance, to achieve their financial and personal goals. When asked if they would seek a financial advisor, 42.10% were not sure, 36.84% would not, and the rest of the participants, 21.05%, would. That is a small percentage that would seek professional advice, which means most of the respondents are pretty confident in reaching their financial goals in life. While confidence is essential in life, there is also a tendency for people to overestimate their abilities, which is very common. To avoid such biases, investors must do their due diligence, in which case research and proper preparations must be done.

Sources

https://www.morningstar.com/articles/1026616/these-sectors-performed-best-and-worst-in-the-pandemic