Sarah Pulkowski

President, Towson University Investment Group

Jacob Piazza

Portfolio Manager, Towson University Investment Group

Keyur Patel

Vice-President, Towson University Investment Group

Aleksandr Olshanskiy

Compliance Officer, Towson University Investment Group

Introduction

The Towson University Investment Group (TUIG) conducted a survey concerning the extent to which Towson University students have knowledge of retirement and financial planning concepts. Basic demographic and education-related information was first queried, followed by retirement planning and respondents’ knowledge of available financial instruments. In total, we had 26 respondents. With the existing macroeconomic backdrop as it currently stands – divergence between the S&P 500 and SMID cap equities, and treasuries at an all-time low after accommodative actions by the Fed – retirement planning, we surmised, is especially important for new college graduates. Key questions in the survey included: When do you want to retire? How much do you need to retire? What percent of your income do you save for retirement each year? How much money do you expect to live on each year while in retirement?

Towson University is composed of the following colleges: College of Business & Economics (CBE), College of Health Professions (CHP), Jess & Mildred Fisher College of Science & Mathematics (FCSM), College of Liberal Arts (CLA), College of Fine Arts & Communication (COFAC), and College of Education (CE). The students questioned were segmented by college. Allowing for inter-college and intra-college comparisons. In addition to segmenting students by college, we also segmented students by major. We conducted the survey in October 2020. With the results of the survey, we were able to show how Towson University students are preparing for retirement, and their overall knowledge of retirement.

Participant Background

The demographics data from our respondents indicates no particular skew to any given population; 53.6% of our participants are between 20-21, while 53.6% are male. In terms of ethnic distribution, respondents were 28.6% Black/African American and 32.1% Caucasian, with the remainder being distributed between Hispanic, Asian, and Native American ethnic groups. We saw a moderate skew towards older students, with more than 80% of respondents having more than 60 credits (Junior and Seniors), which we believe is more applicable to our initial goal of evaluating college graduates’ knowledge of retirement planning concepts.

In seeking to evaluate the sources of retirement planning knowledge, and the potential impact of education by parents, we asked respondents the extent of their parents/ education. More than 80% of respondents’ parents have earned undergraduate degrees or gone on to complete post-graduate education, while only 15% of respondents’ parents had high school diplomas. As graduates of higher education make, on average, more income than those having only graduated high school, we concluded that respondents had a clear skew towards belonging to middle to higher income households. As for respondents’ employment, more than 70% were employed or interning in some capacity. Of the 70% employed, the majority were employed for wages, either salaried or paid by the hour.

While students from every college were among the respondents (save Education), there was a preponderance of students from the College of Business & Economics (CBE). Over 15 students from CBE answered our survey, the majority of which are majoring in Finance or Financial Planning. The average GPA for respondents was 3.25, with a range between 2.1 and 4.0.

Retirement Planning

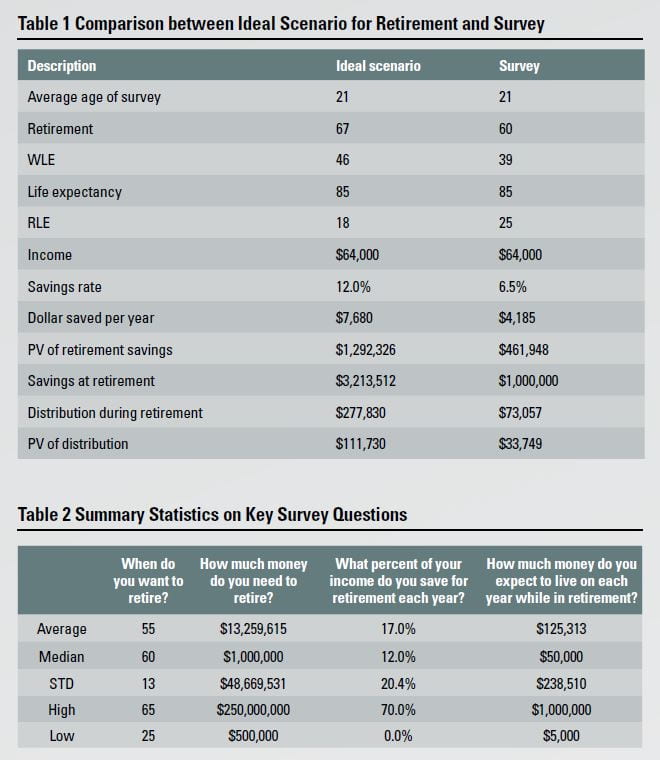

Of our samples, 21.4% of respondents stated they plan to retire at the age of 65. The average and median planned retirement age, 55 and 60 years old, respectively, indicated that, on average, students planned to retire five years or more before the full retirement age. Despite the full retirement age for individuals born after 1960 increasing to 67, TU students plan to retire, on average, at 55 years of age. TU students’ average planned retirement age is also 7 years before they are entitled to begin receiving social security payouts. At age 62, the earliest that an individual can receive social security benefits, only 70% of the social security benefits are received. By retiring early, the accumulation period is reduced while the distribution period is increased, creating the real risk that a retiree will outlive their retirement savings. Table 1 presents a comparison between the ideal scenario for retirement planning and the situation based on our survey.

We report the summary statistics of key survey questions in Table 2. The median and average savings respondents indicated as being sufficient for retirement were

$1,000,000 and $13,300,000, respectively. As far as yearly cash flow needed in retirement, on average respondents stated that they would need $125,000 in retirement. These numbers conclude that students need to make sure they create or have a long-term retirement plan created that is updated and monitored for them to achieve retirement success.

Towson University’s Financial Planning coursework teaches basic calculations required for retirement planning. If a person states to save early in life for retirement, with an appropriate savings rate, they can accumulate enough savings for a comfortable retirement. The ideal scenario’s saving rate for a person in their early twenties is 11%-13%.

With answers varying from $500,000 to $20,000,000, students have a wide range of expectations for savings required to retire. The majority of the respondents said they will save $1,000,000 in preparation for retirement. With the assumption of 2% inflation and 8% annual return on the investment, this gives inflation adjusted return of 5.88% during their retirement. Based on the previous assumptions, if they save $1,000,000 by the time they retire, individuals will have $73,057 of annual distributions from their portfolio during retirement. The present value of the expected annual spending is $33,749. This return is based on aggressive investing even during retirement. These calculations should be reviewed with consideration that a modest change in inflation, retirement life or return on the portfolio will have dramatic effect on the disposable income of a retiree.

Additionally, 10.7% of students have not saved anything for retirement. Since reviewing the survey results and expectations of retirement income, we see that most students are not seriously preparing for retirement. Standard guidelines of financial planning state that, in order to retire, one must save at least 10% of their annual income.

In addition to consistently saving income, retirement account strategies should be considered while planning for retirement. We surveyed students on their expectations regarding tax rates and their knowledge on the relation between tax and social security. Overall, students predict an increase in taxes due to inflation and the overall long-term impacts of Covid-19. Students at Towson University have a broad understanding of how this government funded retirement program works, perceiving it to be the following1: “Social Security is government provided disability and retirement income. For most citizens, after the age of 75, one can receive social security. Before then, social security taxes 6.2% are taken out of each paycheck for employed individuals. It is a form of compensation for older citizens, citizens with disabilities, and citizens that are widow(er)s.” Social security benefits, in actuality, can be received as early as 62 (with penalties), and by 67 without penalties. Each individual’s social security benefits vary depending on how much they earned and how long they contributed to social security. 14 out of 26 respondents (53.9%) were able to correctly answer basic questions regarding Social Security, while the remaining had no knowledge or with misconception.

Though many students do not have a complete knowledge of retirement, nor have they adequately planned for retirement, 76% of students indicated that they will seek financial planning advice in the future. Seeking the advice of a Financial Professional will help to ensure that one will be able to enjoy their golden years and possibly extend the number of golden years an individual may enjoy. The answers provided by students demonstrate that those who are studying finance related subjects have an excellent understanding of Social Security, Retirement Planning, and Alternative Investments. The survey conducted by the Towson University Investment Group finds that Towson University is producing individuals who are capable, well educated, and aware of the current economic and financial market conditions. Towson University is producing individuals who can network and rely on each other to meet the demands of knowledge that all aspects of life require, including financial planning and retiring.

1. Definition was created by compiling the correct or partially correct answers from respondents.