Farhan Mustafa, CFA

Head of Investment Risk Management and Head of Quantitative Investments, ClearBridge Investments

CFA Society Baltimore held its Future of Finance conference at the Baltimore Marriott Waterfront hotel on November 15, 2019. We had the privilege to host The Honorable Sheila C. Bair as the keynote speaker. Here is a brief profile of Ms. Bair, followed by a synopsis of her comments, with some editorial additions for context and data where necessary. In summary, Ms. Bair is concerned about several developments in lending markets that fall outside of traditional banking. The U.S. consumer remains healthy, which is supportive of economic growth, but the student loan picture is worrisome. Over the long run, Ms. Bair is optimistic about several developments in the technology sector that have the potential to improve the financial system.

Ms. Bair has had a long and distinguished career in government, academia, and finance. She is best known as Chair of the Federal Deposit Insurance Corporation (FDIC) from 2006 to 2011, when she steered the agency through the worst financial crisis since the Great Depression, working to bolster public confidence in the nation’s banking system. She received numerous awards and recognition for her leadership at the FDIC, including the JFK Library’s Profiles in Courage Award. She was twice named by Forbes Magazine as the second most powerful woman in the world and was dubbed the “little guy’s protector in chief” by Time Magazine. Time also placed her on the coveted “Time 100” most influential people, and profiled her on its cover, along with Elizabeth Warren and Mary Schapiro, as one of the “New Sheriffs of Wall Street.” In 2012, CFA Institute and The Pew Charitable Trusts founded the Systemic Risk Council (SRC), which was led by Ms. Bair. The SRC’s goal is to improve systemic risk oversight and to give investors greater confidence in global financial markets. Ms. Bair currently serves on several corporate and fintech boards, while continuing her advocacy for common sense policies to promote financial system stability and responsible lending practices, including most recently, her strong national leadership against rising college costs and excessive student debt.

Student debt has grown by 33% over the past five years, the fastest-growing segment of consumer credit over this period, and currently stands at $1.6 trillion versus $1.0 trillion in credit card and $1.2 trillion in auto loan debt.

The 2008-2009 financial crisis was rooted in the nation’s financial institutions, including the banking sector. In the current cycle, Ms. Bair noted several worrisome developments in the non-financial segment of the economy, including leveraged loans, corporate debt, student debt, and federal debt. Ultimately, she is concerned that stresses in the leveraged loan market could catalyze into an economic recession.

Ms. Bair noted that the amount outstanding of leverage loans has exploded in recent years and defaults in this segment could result in another financial crisis. At the same time, the reduced role of synthetic derivatives in the current market is positive as these instruments were at the epicenter of the 2008-2009 financial crisis.

A leveraged loan is typically extended to corporations or individuals that already have high levels of debt and/or low credit ratings. Leveraged loans tend to feature higher risk of default and therefore carry higher interest rates and are most costly to the borrower. According to the Bank of England’s July 2019 Financial Stability Report, gross issuance of leveraged loans in the U.S. reached a post-crisis high in early 2018 but has slowed since then. The share of new leveraged loan issuance with no maintenance covenants has more than tripled since 2007 and remains close to record highs in 2019. Other traditional investor protections in loan terms have also been relaxed (such as restrictions on borrowers’ ability to transfer collateral beyond the reach of the lender), potentially increasing losses to lenders in the event of default. Finally, borrowers are also increasingly indebted globally, with the average reported debt to EBITDA (earnings before interest, taxes, depreciation and amortization) ratio of the borrowers issuing new leveraged loans around levels observed in 2007.

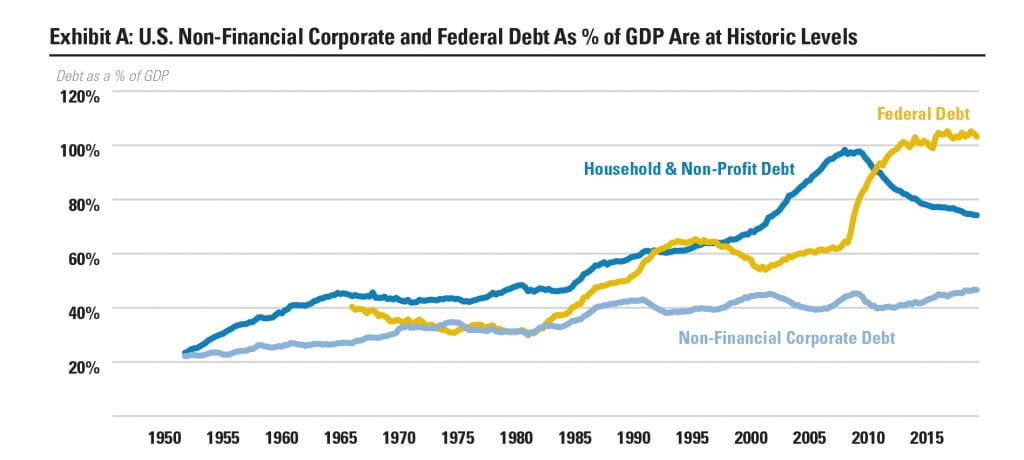

Debt issued by U.S. corporations is another area of concern. Companies have taken out record levels of debt (Exhibit A), largely due to nearly a decade of record-low interest rates. This has not been a problem so far, but the current level of leverage is worrisome because the cost of servicing this debt could create financial distress in a higher interest rate environment. According to the Bank of England’s July 2019 Financial Stability Report, US corporate debt is above pre-crisis levels as a share of GDP and, in part reflecting rapid growth of leveraged lending, the share of debt owed by highly leveraged US companies has reached pre-crisis levels of above 40%. Ms. Bair is also concerned about the rising level of federal debt (Exhibit A) for similar reasons. Specifically, the federal government has proven adept at spending money but the overall lack of fiscal responsibility and the current administration’s policies to weaponize the dollar are concerning.

On the positive side, the U.S. consumer is in good shape, with a strong labor market and manageable household debt (Exhibit A). At the same time, young consumers are saddled with historic levels of student debt (Exhibit B). Ms. Bair noted that this type of debt is generally considered “good” debt because it is being used in productive investment into the labor force, but this does not appear to be the case in the current cycle. According to Federal Reserve data, student debt has grown by 33% over the past five years, the fastest-growing segment of consumer credit over this period, and currently stands at $1.6 trillion versus $1.0 trillion in credit card and $1.2 trillion in auto loan debt. According to Bloomberg News, the cost of tuition at private and public institutions is touching all-time highs, while interest rates on student loans are also rising, increasing the risk that student loan default rates could exceed levels experienced after the 2008 financial crisis.

In response to an audience question, Ms. Bair noted that the ongoing issues in the overnight repurchase (repo) market are also concerning. She expects these movements have nothing to do with regulations but are likely due to bank deposits being too low. Following the financial crisis, the U.S. Treasury moved its deposit accounts from commercial banks to the Federal Reserve. On September 16, 2019, quarterly estimated taxes were due, and the U.S. Treasury issued securities, which caused commercial bank balances to be too low to support the repo market. Ms. Bair is sympathetic with the Federal Reserve’s decision to inject liquidity into this segment and noted that the situation should improve with the yield curve not being inverted any more.

Earlier this week, the Bank of International Settlements (BIS) released its December 2019 quarterly review, in which they discussed repo market stress. BIS explained that the repo market has become heavily reliant on four banks as marginal lenders. These banks’ liquid assets have skewed more toward Treasury securities, which limited their ability to supply short-term funding. At the same time, increased demand for funding from leveraged financial institutions likely compounded the stress, which was further amplified by the Federal Reserve’s withdrawal of large-scale asset purchases in a market that had become used to the availability of abundant reserves.

Meanwhile, Ms. Bair is optimistic about several exciting developments in the technology sector that have the potential to improve the financial system.

Distributed ledger technology is the most promising among these. A distributed ledger comprises a network of replicated, shared, and synchronized digital data geographically spread across multiple sites, countries, or institutions, which use a peer-to-peer network and consensus algorithms are required to ensure replication across nodes. When a network participant updates their copy of the ledger with a new transaction, each node constructs the new transaction, and then the nodes vote by consensus algorithm on which copy is correct. Once consensus has been determined, all the other nodes update themselves with the new, correct copy of the ledger. The blockchain system underlying crypto currencies such as Bitcoin is one example of the distributed ledger technology.

The distributed ledger technology has tremendous potential to increase efficiency and productivity in the financial markets. For example, this technology could revolutionize interbank transactions by removing intermediaries and minimizing counterparty risk. From the perspective of a regulator, every individual and business in an economy could maintain an account at the central bank, which would facilitate seamless transactions as well as regulatory oversight. Private business cannot do this on their own, but this is a promising idea for a central bank. In fact, China is already adopting distributed ledger technology into its financial system and other central banks are also looking into it, including the U.S. Federal Reserve.

Ms. Bair is not very enthusiastic about artificial intelligence (AI) because current applications are limited to tasks that can be algorithmized and because AI systems are good at identifying correlation but not causation in a system.

Ms. Bair noted that applications of artificial intelligence are limited to areas where some task or procedure can be fully algorithmized, but such systems are not effective in systems where all possible outcomes are unknown, and decisions need to be made in the presence of uncertainty. Another issue with artificial intelligence is that it is very good at identifying correlations but does not have the capacity to identifying causal relationship. One of the most basic tenants of statistics is that correlation does not imply causation. We can only trust a model to perform as expected over time if we understand its theoretical basis. Moving beyond correlation to causation is especially important when it comes to understanding the conditions under which a machine learning model may fail, how long we can expect it to continue being predictive and how widely applicable it may be. Current AI systems are good at learning from past data, but these systems largely rely on pattern recognition to develop predictive models without an understanding of how and why the models work.

In conclusion, Ms. Bair is optimistic about the role of new technologies in shaping the landscape of our financial system, but the road directly ahead is likely to be bumpy due to excesses in the non-financial segments of the market and the risks these excesses pose for markets and the economy.

Sources:

CFA Institute Co-Sponsors Systemic Risk Council Led by Former Bank Regulator Sheila Bair https://blogs.cfainstitute.org/marketintegrity/2012/06/06/cfa-institute-co-sponsors-systemic-risk-council-led-by-former-bank-regulator-sheila-bair/

Bank of England’s Financial Policy Committee Financial Stability Report, July 2019

Bank for International Settlements Quarterly Review – International Banking and Financial Market Developments, December 2019

Board of Governors of the Federal Reserve System

Griffin, Riley, The Student Loan Debt Crisis Is About to Get Worse, Bloomberg News, October 17, 2018. Retrieved from https://www.bloomberg.com/news/articles/2018-10-17/the-student-loan-debt-crisis-is-about-to-get-worse on December 10, 2019.

Heltman, John, What Ongoing Repo Turmoil Means for Banks, American Banker, December 3, 2019. Retrieved from https://www.americanbanker.com/list/what-ongoing-repo-turmoil-means-for-banks on December 11, 2019