Niall H. O’Malley, MBA

Portfolio Manager, Blue Point Investment Management

Technology companies are one of the most challenging industry sectors of the economy in which to invest. The risk of failure is above average. New technologies require huge amounts of capital investment before they realize their revenue potential, so the investor bears the cost of building before customers come. Further, valuations are enormous, and the profits are often nowhere to be found. The creative/destructive cycle associated with innovation means there is enormous change. It is important to remember change creates both dislocation and opportunity. Technology is changing how we access information and communicate. Many of the technologies that will shape tomorrow are already present today. The challenge, for the purpose of this article, is identifying the public companies that will offer innovations that will gain acceptance, be perceived as value-added products or services, or even become essential to daily life.

Why Are Productivity and Technology Going in Different Directions?

In our day-to-day lives, technology increasingly impacts our use of time: both positively and negatively. Emails speed communication, but each time we open an email account we often scan for the emails which can be deleted and for those that might be malicious. We also engage with a variety of social media for entertainment, browsing posts and videos, generally not a productive use of time. At the other end of the spectrum, online shopping can be incredibly efficient, allowing us to order in minutes cars, homes, trips, and to research medical treatments. The contradiction is that technology creates both time savings and the ability to squander time. At the positive end of the spectrum, when technology saves time, it proves challenging to measure if the number of goods/services produced does not change. Traditional metrics for economic activity measure the value of transactions during a given period, but do not factor in time savings. At a macro-level, the traditional measure of economic activity, Gross Domestic Product (GDP), multiplies the number of transactions that occur in a measurement period times the value of the transactions. Time savings is not factored into GDP, which is a traditional measure of economic activity.

Why is Productivity Important?

Productivity and labor force growth drives increases in living standards. New and more effective methods of accomplishing tasks – productivity – allow people to accomplish more with less. Productivity enhancements drive living standard increases. When productivity increases 1% annually, the living standard doubles in approximately 70 years, but if productivity increases 2% annually, the living standard doubles in approximately 35 years. Productivity helps fulfill the traditional wish of parents: for their children to have a better life than they experienced.

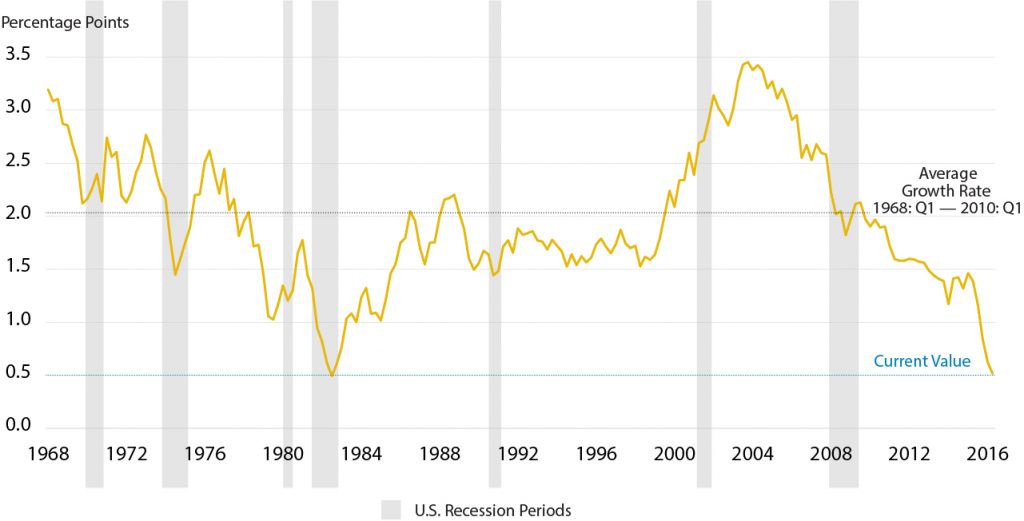

Why is it that when technology seems to permeate our everyday lives more and more that productivity in the U.S. has fallen from a 2% annual increase prior to the 2008 financial crisis to below 1% today? There is no easy answer to this disconnect, but there are structural factors in the U.S. economy that are impacting productivity.

Figure 1: Productivity Growth 25 Quarter Rolling Average

A key challenge is that time savings associated with new technology and software applications are more difficult to measure than past technological advances. For example, in agriculture, mechanized technology, seed research and fertilizer have dramatically reshaped productivity. In 1900, over 38% of the U.S. labor force worked in agriculture, however today less than 2% of the U.S. labor force works in agriculture. Labor force participation in agriculture has dropped to a fraction of turn of the century levels while at the same time productivity of U.S. crop lands has skyrocketed. There are many concerns about technologies eliminating jobs, but have you ever heard anybody complain about not having to till a field. All of the increases in agricultural productivity, including packaging, cooling and transportation, are easy to measure in terms of crop yields. The amount of agricultural product produced times the price of the agricultural product creates a measurable economic impact. Unlike agricultural productivity, which is easy to measure, many of the new technologies today save time but the productivity impact is not showing up in traditional economic measures like GDP.

Why is there a disconnect between productivity in the economy when investors are falling over themselves to invest in large-cap technology companies such as FAANG (Facebook, Apple, Amazon, Netflix and Google) stocks? While new technologies save time, they do not guarantee that the time saved is used productively. Facebook viewing, while entertaining, is not a source of productivity. The same can be said for YouTube videos and cleaning out an overcrowded email box.

Technology Sector Valuation Considerations

As the effectiveness of technology has grown, job losses have moved from blue to white collar jobs. Continued advances in technology and automation threaten job categories across a wide variety of industry sectors. It can be argued that fear and the seeming inevitability of job loss is driving above average investment in technology companies. If white collar investors cannot enjoy the benefit of employment, they can at least recoup rewards as investors. This defensive reaction – while difficult to prove – is a potential driver pushing technology valuations higher.

The unusual level of interest in FAANG stocks may be driven by more than just passive investing and stock indexes like the NASDAQ Index that favor FAANG stocks. When are you paying too much? Understanding valuation is one of the most challenging aspects of investing in technology stocks. For example, Facebook is valued at over 14 times sales at the time this article goes to print. This means every dollar of increased sales causes the market-capitalization (the number of Facebook shares outstanding times the share price) value to increase $14. When is the valuation too rich?

How Can a Loss Generating Company Be an Investment?

Other important considerations with new technology are the lifecycle and strategic development of the company. First and foremost, technology companies have to build the product or service before the customer will come. The dramatic losses and capital needs associated with the up-front investment typically create a sea of red in the income statement. This raises a variety of questions for an investor to consider: to what extent will the company differentiate its product and/or service? What are the customer acquisition costs? Has the company largely completed the research and product development process? Does the company intend to build market share by pricing the product as a loss leader in order to gain market share? Careful attention needs to be placed on market share gains. Investing in a market share-leading company can be a hedge, but one with the unpleasant reality that the company’s valuation relative to sales and later earnings can be priced to the moon.

Further complicating issues, there is an increasing winner-take-all trend in today’s market. The trend is not unique to the technology sector, but it is more pronounced there. Understanding where technology companies can take market share from historic providers is key. For example, Amazon is creating value propositions for its customers that traditional brick-and-motor retail companies cannot match. At the same time, building an increasingly complex logistics and technology platform and competing with more and more retailers has enormous risks.

Other technology-enabled companies are lowering the cost and ease of a service, whether it be requesting ride sharing or reserving overnight accommodation. By offering customers more optionality than traditional taxi services or hotel providers, technology-enabled service providers are taking market share from traditional service providers who find themselves increasingly forced to be price takers rather than price setters. Scalable technologies in this sector are creating economies of scale and ease of use that traditional taxi services and hotels struggle to compete with.

If the Income Statement Bleeds Red What Do You Look For?

Once technology companies leave the emerging stage, they have largely completed the research and development phase and enter the build-it-and-they-will-come stage. The scalability during this growth stage is impressive, but revenue potential has been only fractionally realized. The cost associated with building out their platform creates a sea of red in the income statement as losses often exist below the gross margin level on down. Access to public markets becomes very important as secondary stock offerings become a primary source of capital. From an expense perspective, the biggest cost is often human capital. Key talent is attracted by stock options which align the individual’s financial success with the success of the company. The scalability during the growth stage is impressive, but the staggered rollout of updates and new features can lead to dramatic double-digit losses in the company’s common stock as interruptions in growth occur.

So How Do You Gauge Success?

Investors should look for a product or service that resonates with consumers. Something that is more than a fad, and has scalable, long-term economic potential. Strong founder involvement is often key. Are the founders cashing out, or are they committed to the company’s growth? Do they have an executable vision? Financial flexibility is a necessity: does the company have the ability to weather the inevitable setbacks associated with scaling a new product? Are there barriers to entry? Is the product easily mimicked? Growth will attract competition, but the extent to which the company is protected by switching costs, cost advantages and economies of scale help it become a market leader.

An important measure of success is cash from operations. Simply put, if you run a lemonade stand, is there cash in the till after selling the product? This can be a more relevant measure for software companies that have almost no marginal cost for an additional software license versus technology companies producing a physical product. Software companies can have powerful business models that benefit from networks effects, and low cost scalability. Successful software companies see an above average portion of incremental revenue convert to cash flow. Technology companies that produce a physical product will have a growing inventory cost which, in a high-growth scenario, can create negative operating cash flow when the inventory cost absorbs the cash generated by product sales.

A Global Perspective on Technology and a Local Twist

Risk Taking Culture

With the leap of faith necessary to start and grow a technology company, these ventures need a risk-taking culture to succeed, and from a cultural perspective, the U.S. has a unique risk-taking culture that has created an unrivaled development center in places like Silicon Valley. The combination of ingredients that enables a technology company to succeed include an endorsement of disruption, gifted entrepreneurs and human capital, venture capital, and later, public market capital. The most important consideration is a risk-taking culture that also protects intellectual capital. Areas such as Silicon Valley attract intellectual talent from around the world, and stock options are used to align human capital with companies’ success. Attracting the best human capital with their ideas, technological know-how and the willingness to take large risks is key to staying one step ahead of the competition. From a cultural perspective, the U.S. encourages risk taking. It is this appetite for risk that is a critical, though relatively silent, ingredient to the success of technology companies.

Compare the American success in the technology sector with that of Germany, long favored as a leader in manufacturing. Germany is largely a debt-based society where public equity ownership accounts for only approximately 15% of publicly traded investments. Due to risk aversion, Germans favor fixed-income investments such as bonds, real estate and insurance products. In the U.S. public equity ownership typically exceeds 50% of investments because U.S. investors use Individual Retirement Accounts (IRAs) and 401(k)s to save for retirement. Germany has a strong pension system and does not offer IRAs, which help fuel the U.S. equity risk-taking culture. In Germany, nine out of ten companies are private. Germany is a world leader in manufacturing and is very willing to invest in manufacturing, but when you look for public technology companies in Germany, they are hard to find. Why? The equity culture, as a proxy for willingness to assume risk, does not exist there to the same extent as in the U.S.

Is the Barn Door Open?

Risk averse cultures, like Germany, do not embrace disruptive technologies as readily as the U.S., but other countries embrace forced technology transfer by appropriating and re-branding technology. In the U.S., this is viewed as theft, but governments in other countries have strategic plans designed to accelerate forced technology transfer. Unfortunately, access to the Chinese market is designed to facilitate this kind of technology transfer. Multinational companies desire access to the world’s largest single market, but those seeking access to the Chinese market must think very carefully about how they structure the required joint ventures. The Chinese government encourages harvesting foreign intellectual property to create domestic competitors, whether it is a joint venture partner becoming a competitor or outright theft of intellectual property. It is a curious relationship since China dominates the production of technology hardware. For multinational companies, participating in the Chinese market is not an option. Whether at either the production or consumption level, the Chinese market is simply too important to be ignored. Segmenting production elements and protecting source code or design elements are key pre-cursors to developing a presence in the Chinese market. Software companies are exposed to an above average risk as they seek to protect their source code, as was the case for Google in 2010. For smaller technology companies, avoiding the Chinese market may be the best course of action.

How Do You Protect Intellectual Property from Cyber Theft?

It is as important to safeguard technological innovation domestically as it is globally. How to protect intellectual property from cyber theft is perhaps one of the most challenging questions because while the threat is very real, the specific nature of the threat is not known. From a business perspective, most technology companies provide a service which can be benchmarked against alternative options. For example, ride sharing can be benchmarked against traditional taxi services and overnight reservation services can be benchmarked against hotel companies. However, cyber security threats are black boxes; the nature of the solution is not known since the nature of the code-based threat is not known. The best protection is a layered defense with redundancies because the weakest link is often not known. Given the unusual nature of cyber security threats that may come from an exploited weakness in an operating system or a phishing email that gets a victim to compromise their computer and potentially a network with an encryption program, it is extremely difficult to protect companies against an unknown threat that may require a yet-undeveloped solution.

A Local Twist

Maryland has a leading position in cyber security. There are over 50,000 employees working for the National Security Agency which is based in Fort Meade, Maryland. The surrounding area has become a hotbed for government contractors and has progressively become an innovation cluster of incubators, universities, and the state and federal government, all of whom actively facilitate the necessary ingredients to spur innovation and the formation of cyber technology companies. That Maryland is at the forefront of this industry should come as no surprise as the state has a long history of investing in new technology. Whether through venture capital, private equity, investment banking or buy-side investor Maryland has a strong history of investing in technology. Some of the representative firms are the Abell Foundation, New Enterprise Associates, ABS Capital Partners, Camden Partners, Stifel, Brown Advisory and T. Rowe Price.

Investing in Technology Companies Not for the Faint of Heart

Investing in technology companies is challenging and not for the faint of heart. While the potential upside can be tremendous, the winner-take-all trend means there are a lot of losers out there too. Investors in publicly-traded companies can experience a loss of capital that exceeds 40% in a single day which means diversification is paramount. Diversification both within the technology sector and across other industries is necessary to protect against downside risk. Key questions include, but most certainly are not limited to: Is the technology scalable? Is the company a market share leader? Is the company gaining market share? Can the company become profitable? Does cash flow from operations exhibit a positive trend? Is growth coming from internally generated sales, or is the company a roll-up that is dependent on acquiring other companies? Does the company have financial flexibility to survive setbacks? Is customer adoption strong? Is the company protected by high switching costs and/or barriers to entry? If the investment is a failure, when will you cut your losses? There is no complete list on how to invest in technology companies, but the importance of technology in our daily lives is growing. A thoughtful approach to investing in public technology companies allows direct participation in the creative/destructive cycle that represents some of the highest levels of growth in our technology-enabled economy.

This article represents personal opinion and should not be considered investment advice. The intent of the article is to be educational.

Sources:

https://www.agclassroom.org/gan/timeline/farmers_land.htm

https://www.cnbc.com/2017/07/27/robert-shiller-fear-of-robots-is-driving-the-market-rally.html

https://www.reuters.com/article/linkedin-results-research/linkedin-sheds-11-billion-in-value-on-stocks-worst-day-since-debut-idUSKCN0VE1N0

https://www.clevelandfed.org/en/newsroom-and-events/publications/economic-commentary/2016-economic-commentaries/ec-201616-new-normal-or-real-time-noise-for-labor-productivity.aspx

https://www.wsj.com/articles/silicon-valley-doesnt-believe-u-s-productivity-is-down-1437100700

https://research.stlouisfed.org/publications/page1-econ/2017/03/03/the-productivity-puzzle/

https://www.wsj.com/articles/the-mystery-of-declining-productivity-growth-1431645038