By Zachary C. Reichenbach, CFA, CPA/ABV/CFF

Principal, Ellin & Tucker

Cazmier Tymoch

Analyst, Ellin & Tucker

We live in a highly litigious business environment. For those of you who have been involved in a business litigation matter know that the litigation process can be time consuming and very expensive. Litigation cases can take years to resolve and in the process, attorneys and other professionals may incur thousands of hours to litigate the case. Additionally, time and resources may be taken away from business operations if employees need to get involved. This article will introduce the concept of lost profits in corporate litigation and underscore the importance of good record-keeping and detailed financial documents to help you manage through any future litigation.

As a result of the U.S. economy growing and the Tax Cuts and Jobs Act increasing cash flows to businesses, the cash spent on business litigation has grown. With the increase in available cash due to lower taxes, businesses have chosen to spend some of that additional cash in pursuing litigation matters. In 2018 and beyond, forecasters expect to see a 10 percent increase in litigation matters which will result in higher legal and professional costs for businesses. Some large companies are expected to add approximately $1 billion in litigation spending in 2018, and that trend is expected to continue beyond 2018. In addition, settlements for these business lawsuits are reaching record highs, meaning the average payouts are some of the highest on record.

Understanding lost profits can be a deciding factor to winning or losing a case, especially in this current litigious environment.

There can be a variety of reasons why a business might file suit against another business or individual. The reasons could range from a breach of contract, to an insurance claim to intellectual property infringement. Regardless of the reason for the lawsuit, the plaintiff in the matter will likely pursue some form of compensatory damages. One of the most common forms of compensatory damages is lost profits.

For those individuals who have experience with business litigation, it is likely that lost profits was the measure of damages. For those individuals who have not had experience with litigation or lost profits, it is important to know the concepts. Understanding lost profits can be a deciding factor to winning or losing a case, especially in this current litigious environment.

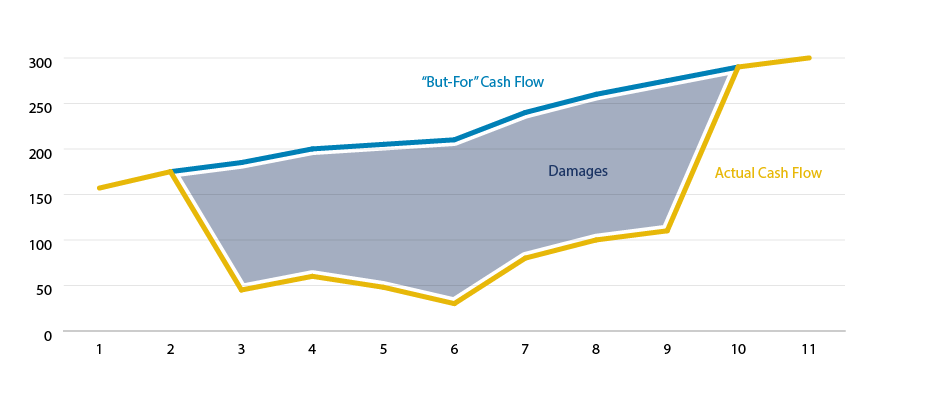

Figure 1: Lost Profits

Lost profits are a measure of the impairment of profits that would have been earned by a business but-for the damaging event. Lost profits are calculated by determining the difference between the profits that would had been incurred but-for the damaging event and the actual profits that occurred after the damaging event.

The calculation of lost profits begins after the damaging event occurs and ends when the business is operating at a level it was prior to the damaging event. The chart above is an illustrative example of lost profits.

There are two lines shown in the chart above. Each line represents a scenario where the profits are calculated.The difference between the two lines represents lost profits; it is depicted as the “middle part.”

The businesses who are successful in litigation tend to be the ones who have credible information through good recordkeeping and detailed financial documents assisting their legal team.

The first line in the chart is the “but-for” scenario. This hypothetical scenario considers the profits that the business would have earned had the damaging event never occurred. The calculation of the profits under this scenario are hypothetical in nature and thus can be speculative since the analysis is not based on reality. The person calculating the but-for scenario would have to put themselves back on the day before the damaging event and determine what the profits would have been at this time, having no idea this damaging event was going to occur. To determine the revenue and variable costs in this scenario, a projection that was prepared prior to the damaging event may be utilized since it was created without any litigation or damaging event in mind. There may be some adjustments that need to be made to the projections, but this can be a starting point in determining lost profits in the but-for scenario. The business needs to consider whether there were new product or service offerings during that time and what the general expectation of the business was before the damaging event. This type of information is relevant to calculating the but-for scenario.

The second line in the chart is the actual scenario. This scenario calculates the actual profits the business earned after the damaging event occurred. This scenario is based on the actual profits earned after the damaging event. This is less speculative than the but-for scenario since the profit calculations are based on actual results.

In a litigation setting, the most credible lost profits calculations are the ones that are based on facts and objective information.

The calculation of profits for each scenario is different than typical accounting profits such as gross profit, operating income or net income. The measure of profits for a lost profits calculation is the contribution margin. Only variable costs (also known as avoidable costs) are deducted from revenues in a lost profits calculation. Fixed costs are typically not deducted in a lost profits calculation. As a result, the profits from each scenario are typically higher than the net income or operating income since fixed costs are not considered. The revenues and variable costs that are included in the calculation should be directly related to the damaged product/service line of the business. For example, if we were calculating lost profits for Proctor and Gamble’s Tide department, we would only include the revenues and variable costs associated with Tide. We would not include Proctor and Gamble’s other brands such as Bounty or Head and Shoulders since these are unrelated to the damaged department.

The difference in the scenarios (lines in the chart) as noted above is lost profits. There is a definitive end period for which lost profits are calculated. In the chart above, the end of the damage period is when the actual profits or cash flows are back at a level they would have been but-for the damaging event. The end of the damage period could be the end of a contract that was breached. In this example, the damaged businesses may not be back at the profit level it was prior to the breach; however, since the terms of the contract expired, there is no presumption of additional profits generated beyond contract expiration.

In a litigation setting, the most credible lost profits calculations are the ones that are based on facts and objective information. In litigation, the business’ counsel may hire a damages expert to calculate lost profits and to testify on their opinions. The attorneys and the damages expert will analyze every document and piece of information available to build a credible and objective lost profits analysis. Typical documentation that is needed includes the business’ financial statements, tax returns, general ledgers, budgets and any projections prepared by the business before, during and after the damaging event. If the business routinely creates budgets and projections, then that can help their legal team build a credible lost profits analysis. The use of management interviews, depositions or interrogatories may be used to get information in the event budgets and projections are not available for the attorney or damages expert.

The opposing party may also hire their own damages expert in the litigation case. In matters where there are dueling experts, the outcome is usually decided by fact-based analysis and objective information. Each expert bases their analysis on the data that is provided from the parties of the lawsuit. To the extent one party can provide more credible information than the other, there can be a positive impact on the litigation matter. Each damages expert may make different assumptions and therefore prepare different projections. However, so long as the financial expert can qualify their decisions and support the basis for these assumptions, their opinion may stand as reliable and relevant. Discussions with management serve a great purpose in identifying projected revenues or variable costs – a major variable in the financial expert’s opinion of lost profits.

Today’s environment is highly litigious, so businesses small or large should anticipate lawsuits in the future. The businesses who are successful in litigation tend to be the ones who have credible information through good recordkeeping and detailed financial documents assisting their legal team. From this style of organized management, a business helps itself in future litigation matters.