Niall H. O’Malley, MBA

Portfolio Manager, Blue Point Investment Management

A good investment becomes a bad investment when it becomes evident to the buyer that they overpaid. This concept applies not only to individual investors, but also in the case of share buybacks, when a company overpays for shares. Typically, share buybacks are used by a company to return earnings to shareholders. The shareholders who do not sell the company shares benefit from having a greater share of the earnings, or a bigger slice of the pie. Two disturbing trends are that increasing numbers of share buybacks do not represent the return of reported earnings or overseas cash and many publicly traded companies have been taking on huge amounts of debt to finance share buybacks when their shares are at record valuations.

Quite simply, when a company overpays for shares, it destroys shareholder value. The value destruction becomes greater when a company borrows money to finance the share buyback, since the company must also pay interest on the debt used to buy back the shares. Further, the increased debt compromises the company’s financial flexibility. Economic downturns and/or unforeseen events challenge companies in unexpected ways, which make financial flexibility and balance sheet equity an important asset. When a company artificially increases earnings per share by decreasing the number of shares outstanding, it is called financial engineering. Many companies have used financial engineering to mask declining sales, including IBM, which had declining sales for 20 consecutive quarters, but showed earnings per share as up every quarter due to massive share repurchases.

What motivates a company’s management team to destroy financial flexibility and engage in debt financed share buybacks? The answer may be that some of the legislative changes following the 2008 financial crisis have had unintended consequences. The Dodd-Frank Act enacted in 2010, requires a say-on-pay vote for public companies giving proxy adviser firms like Institutional Shareholder Services significantly greater influence. Institutional Shareholder Services recommended that 50% of equity awards for management be performance based. The performance goals for senior management are tied to shareholder returns with little emphasis placed on balance sheet strength.

What is Causing Differences in the Capital Market?

In the U.S., equity market valuation levels have dramatically exceeded economic growth since the 2008 financial crisis. Are these valuation levels sustainable? At first blush it would appear to be: The sustained expansion of the U.S. business cycle is the longest on record since World War II. What is different with this business cycle versus earlier business cycles? A critical distinction is that after the Second World War, the U.S. used fiscal policy to create the Eisenhower freeway system, and manufacturers produced goods for a world that needed to rebuild. During the current business cycle the inverse has occurred: U.S. fiscal policy to invest in outdated infrastructure has remained untapped, and domestic manufacturing has struggled to grow. The current business cycle is different in another unprecedented way: It is driven almost exclusively by monetary policy. The Federal Reserve bought fixed income securities by printing trillions of dollars. Equities became a beneficiary of printed money, since it meant there was more money chasing equity securities. Central bank quantitative easing has pushed interest rates to record lows. This has caused the cost of debt to be lower than the return on equities. Public company management teams are arbitraging return advantage created by record low interest rates and pocketing hefty performance awards.

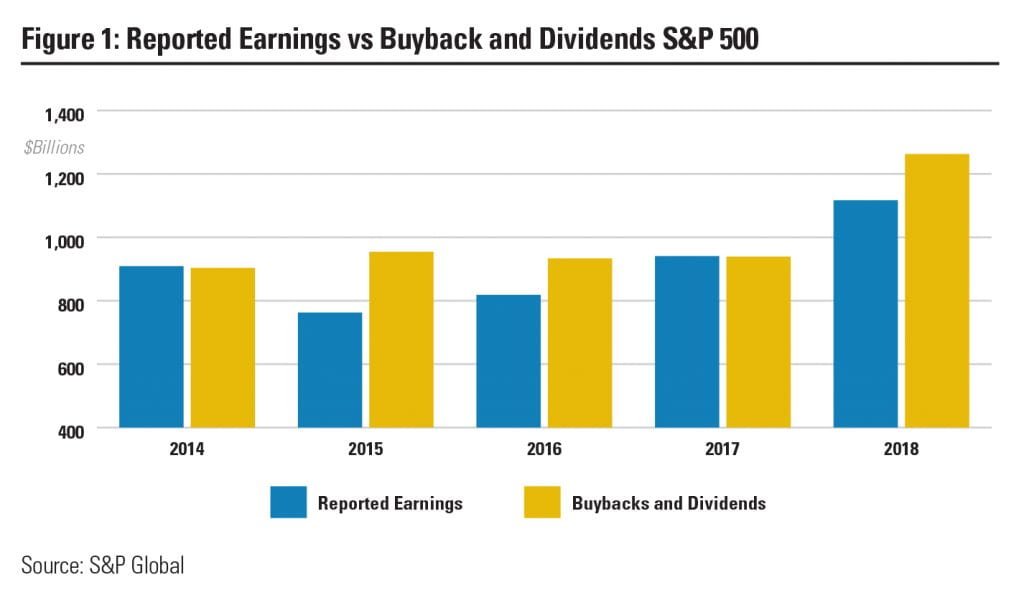

S&P 500 Buyback and Dividends Over the Past Five Years

In three of the last five years, buybacks and dividends exceeded reported earnings for the S&P 500. The 2017 tax reform legislation lowered corporate income taxes and permitted overseas cash to be repatriated, dramatically increasing buybacks and dividends in 2018. What is troubling – as seen in the table on the previous page – is that in 2015 and 2016 buybacks and dividends also exceeded reported corporate earnings in the S&P 500. This means company management teams are consuming more company resources then they produce. The reported earnings per share are not sustainable.

Companies Draining their Balance Sheet with Operations in Maryland

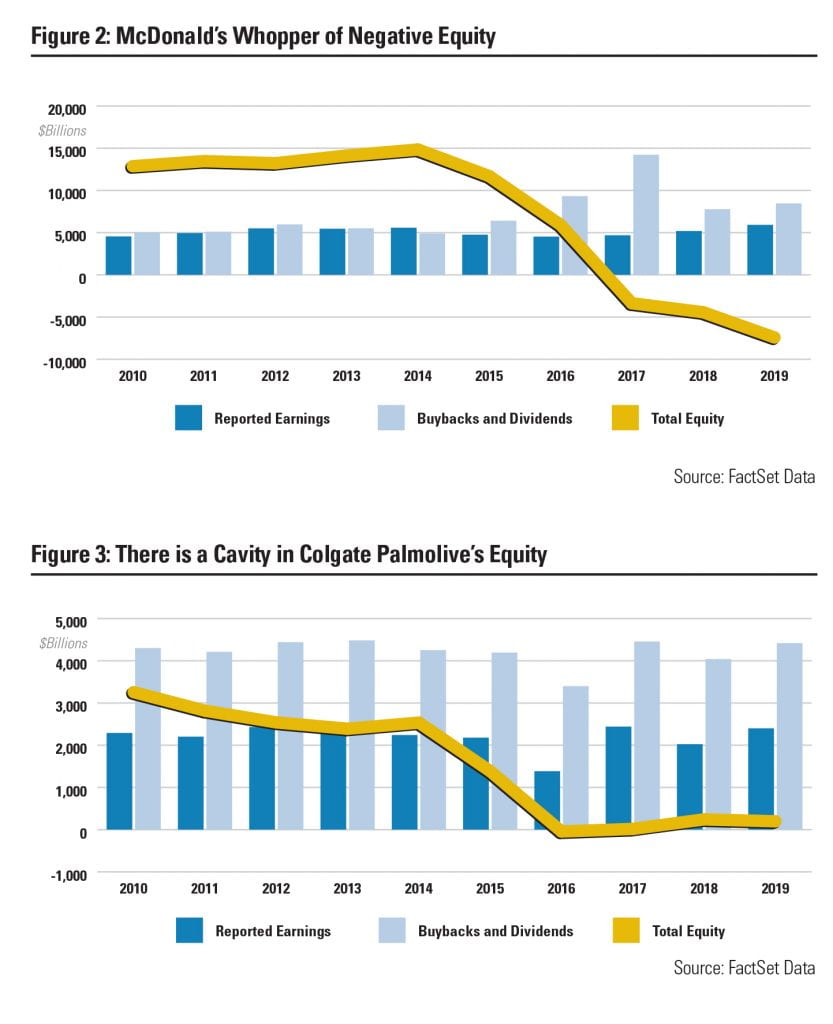

Three companies draining their balance sheets and creating negative shareholder equity with operations here in Maryland are McDonald’s, Colgate Palmolive, and Home Depot. Negative equity is when a company’s liabilities are greater than their assets, which means shareholder equity has a negative value. Share repurchases are not the only reason negative equity can occur. Negative equity can also occur when a company writes down the value of an acquisition. While there are other sources of negative equity, for the purposes of this article the focus is on the discretionary actions of management that create negative equity.

Ten years ago, McDonald’s had over $14 billion in shareholder equity. Today, shareholder equity is less than zero. McDonald’s long-term debt, which is increasingly used to finance share buybacks, has grown by over $31 billion which has helped crowd out shareholder equity. McDonald’s liabilities exceed its assets, which means shareholder equity at the end of 2018 stood at a negative value of -$6.2 billion. While McDonald’s share price has hit new highs, the negative equity value creates genuine questions about sustainability, since the balance sheet already has substantial negative equity. Management is borrowing from the future financial strength of the company to finance today’s performance goals. Overpaying for share buybacks is a real risk.

Ten years ago, Colgate Palmolive had over $3 billion in shareholder equity. Today, shareholder equity is less than $200 million. Colgate Palmolive’s long-term debt has grown by over $3.5 billion which has helped crowd out shareholder equity. Colgate Palmolive has a sky-high return on shareholder equity, but that is due to so little shareholder equity to begin with – less than 2% of assets. Like McDonald’s, Colgate Palmolive’s management is borrowing from the future financial strength of the company to finance current performance goals.

Ten years ago, Home Depot had almost $20 billion in shareholder equity. Today, shareholder equity is less than zero. Home Depot’s long-term debt has grown by over $18 billion which has helped crowd out shareholder equity. Home Depot’s liabilities exceed its assets, which means shareholder equity at the end of 2018 stood in the red with a negative equity of -$1.8 billion. The Home Depot share price has hit a number of all-time highs, partially created in part by management’s choice to deplete the company’s balance sheet. Management is borrowing from the future financial strength of the company to facilitate performance goals.

Conclusion

There is a growing disconnect between the growth rate in earnings per share for companies and the reported earnings growth rate. Share buybacks are materially altering the earnings per share growth rates, which in turn raises questions about sustainable growth. Each of the companies cited have strong cash generation, but the share buybacks in excess of reported earnings are not sustainable. While this article focuses on the troubling growth in negative equity, it important to remember equity is a residual measure. Arguably the most important measure of a business’s strength is the ability to generate cash from operations.

Managers have a responsibility to find the lowest cost of financing, but excessively low interest rates are creating an unhealthy over-indulgence in debt as low-cost debt is used to replace higher cost equity. The distortions created by record low interest rates are increasingly distorting corporate balance sheets. Manager performance goals are further contributing to the incentive to use debt. Taken together, share buybacks have been one of the most powerful forces driving share prices higher. Too much of anything eventually becomes a negative.

The purpose of this article is to discuss a negative trend that compromises financial flexibility in these and other companies using debt to fund share buybacks and boost share price. General Electric could have fixed its own problems if it had maintained balance sheet flexibility rather than spending over $53 billion to buy back shares at higher valuations in the decade prior to 2017. From an active management perspective, Blue Point looks for sustainable trends that support sustainable growth. The growing debt levels associated with share buy backs that exceed reported earnings are troubling, and the elevated levels of share buybacks may not be a good investment.

Resources

https://corpgov.law.harvard.edu/2014/10/02/what-has-happened-to-stock-options/

https://www.institutionalinvestor.com/article/b1dfj9g9mfnqxb/Share-Buybacks-May-Be-Bad-Just-Not-for-the-Reasons-You-Think

https://thesoundingline.com/dividends-and-buybacks-now-larger-than-total-reported-earnings-for-the-entire-sp-500/

https://www.theatlantic.com/magazine/archive/2019/08/the-stock-buyback-swindle/592774/

https://www.cmgwealth.com/wp-content/uploads/2017/03/document_1072753661.pdf?mod=article_inline

https://www.wsj.com/articles/where-have-all-the-public-companies-gone-1510869125

https://www.cfo.com/credit-capital/2019/10/imf-warns-of-19-trillion-corporate-debt-risk/

https://fortune.com/2019/08/22/ge-stock-buybacks-financials/