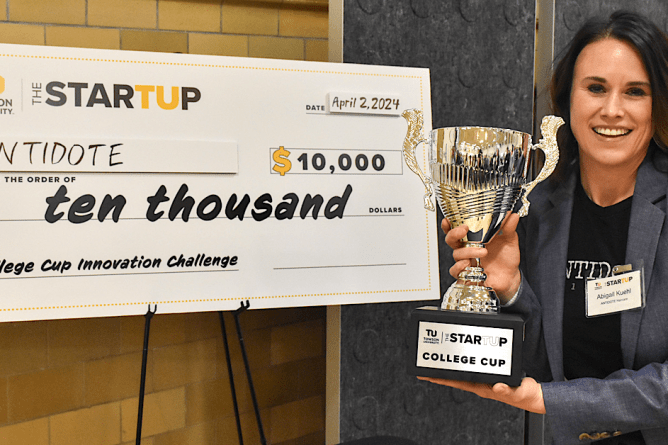

Antidote Haircare, a plant-powered haircare brand developed by Abigail Kuehl, a Towson University College of Business and Economics student, won the third annual College Cup.

Kuehl was one of seven finalists to pitch at the April 2 event, held at the StarTUp at the Armory in downtown Towson. She took home a cash prize of $10,000 to put towards her venture and a spot in the 2024 StarTUp Accelerator, where she will join several other founders for eight weeks to collaborate and accelerate their ventures.

“Thank you so much. I didn’t honestly think I was gonna win. I really came into it for the experience. Throughout this journey working with [the StarTUp Team] I have learned so much. Their feedback was so helpful and it was non-biased, and that’s exactly what I needed. I needed the outside perspective,” said Kuehl during her acceptance.

Kuehl boasts a wealth of experience as a master stylist and boutique salon owner and has a passion for addressing her clients’ needs. She’s committed to crafting a professional brand centered around clean, ingredient-first formulas. Along with her business partner, David Calle, they brought together product developers, stylists, and product testers to develop their brand.

“This has been a journey for me and I’ve put my heart and soul into this business. I hope you can tell. And I’m really out here to make a difference and make healthy living easier for people. That’s really the goal. So thank you again,” she added.

The College Cup is a university-wide challenge that helps students develop new socially- or commercially-oriented ideas and innovations to positively impact the world.

This year, a record number 25 student-led ventures applied for the challenge. Students came from nearly every TU college. Eventually, 15 ventures made it through all the programming, which includes a bootcamp, submitting an executive summary, a “learn to pitch” classroom session, and practicing pitching to the StarTUp team. The students also had access to and gained feedback from members of the ETU Council, a coalition of faculty and staff engaged in developing and strengthening entrepreneurship across campus.

Seven made it through to the end. And, over the course of the last several weeks, they honed their ideas, developed pitch decks, and refined their pitches before pitching in front of a live audience and a panel of business leaders and TU alumni.

The other six finalists include:

- Campus Connect, led by Xavier Sabree and Derek Knight: An app that connects college students with other student entrepreneurs/student-run companies on campuses.

- Dropped, led by Aliya Pemberton Lightbourne: A platform/business that gives commuter students access to bus transportation to and from campus.

- Events by Elle B., led by Lianna Banks: An event planning company.

- MAI PT, led by Molli Chang: An app for physical therapy patients to remind them of at-home physical therapy exercises and uses AI technology to guide patients through PT goals.

- My Campus Hubs, led by Andres Londoño, Jake Furtaw, Matt Dibbern, William Duckworth III, Caleb Blomquist and Ryan Kraft: An app that connects college students with each other socially, with professors and classmates academically, and with the community surrounding their campuses.

- Urban Companions, led by Anastasia Kolomytseva and Eliza Petrova: An app that connects college students with shared housing options off campus.

The finalists each received $1,000 to put toward their venture.

(This article has been reproduced from EngageTU and was originally written and posted by TU StarTUp on April 4, 2024.)