audio

Virtual Reality And Beyond: The Future Of Music Experiences

As virtual reality technology continues to grow and develop, becoming increasingly accessible to consumers, its convergence with music is creating a number of exciting opportunities in the industry.

Source: Virtual Reality And Beyond: The Future Of Music Experiences – hypebot

Tech giants are betting on screen-enabled smart speakers

Over the past few days Google, Baidu, and Facebook, among others, have announced smart display products or strategies.

Source: Tech giants are betting on screen-enabled smart speakers – Business Insider

YouTube’s in-app messaging and Community tab to make their way to YouTube TV, YouTube Music

The trends and events that will matter at CES 2018

New gadgets get lots of hype at the annual tech trade show CES. But trends such as voice computing and augmented reality will be more significant.

Source: The trends and events that will matter at CES 2018 – Business Insider

Google Street View Now Has A Soundtrack, Thanks To AI

You can now surf its endless network of streets accompanied by what a machine thinks you’re likely to hear there.

Source: Google Street View Now Has A Soundtrack, Thanks To AI

What Music Has In Common With Bookstores And Swiss Watches

Despite their turbulent sales histories and brushes with obsolescence, print on paper books and Swiss watches have both managed to make impressive rebounds and have of late shown steady profitability. Here we look look at some important takeaways that could potentially apply to the music industry.

Source: What Music Has In Common With Bookstores And Swiss Watches [Jack Kelly] – hypebot

YouTube’s Unlikely Peacemaker Plans to Make Musicians Rich

Music execs mingling with Ed Sheeran and Selena Gomez at a recent party thought the enemy was in their midst: YouTube CEO Susan Wojcicki.

Source: YouTube’s Unlikely Peacemaker Plans to Make Musicians Rich | Digital – AdAge

MIDiA Research Predictions 2018: Post-Peak Economics

Music

- Post-catalogue – pressing reset on the recorded music business model: Revenues from catalogue sales have long underpinned the major record label model, representing the growth fund with which labels invested in future talent, often at a loss. Streaming consumption is changing this and we’ll see the first effects of lower catalogue in 2018. Smaller artist advances from bigger labels will follow.

- Spotify will need new metrics: Up until now Spotify has been able to choose what metrics to report and pretty much when (annual financial reports aside). Once public, increased investor scrutiny on will see it focus on new metrics (APRU, Life Time Value etc) and concentrate more heavily on its free user numbers. 2018 will be the year that free streaming takes centre stage – watch out radio.

- Apple will launch an Apple Music bundle for Home Pod: We’ve been burnt before predicting Apple Music hardware bundles, but Amazon has set the precedent and we think a $3.99 Home Pod Apple Music subscription (available annually) is on the cards. (Though we’re prepared to be burnt once again on this prediction!)

Video

- Savvy switchers – SVOD’s Achilles’ heel: Churn will become a big deal for leading video subscription services in 2018, with savvy users switching tactically to get access to the new shows they want. Of course, Netflix and co don’t report churn so the indicators will be slowing growth in many markets.

- Subscriptions lose their stranglehold on streaming: 2018 will see the rise of new streaming offerings from traditional TV companies and new entrants that will deliver free-to-view, often ad-supported, on-demand streaming TV.

Media

- Beyond the peak: We are nearing peak in the attention economy. 2018 will be the year casualties start to mount, as audience attention becomes a scarce commodity. Smart players will tap into ‘kinetic capital’ – the value users give to experiences that involve their context and location.

- The rise of the new gate keepers part II: In 2018 Amazon and Facebook will pursue ever more ambitious strategies aimed at making them the leading next generation media companies, the conduits for the digital economy.

Games

- The rise of the unaffiliated eSports: eSports leagues emulate the structure of traditional sports, but they may have missed the point. In 2018, we’ll see more eSports fans actually seeking games competition elsewhere, driving a surge in unaffiliated eSports.

- Mobile games are the canary in the coal mine for peak attention: Mobile games will be the first big losers as we approach peak in the attention economy – there simply aren’t enough free hours left in the day. Mobile gaming activity is declining as mainstream consumers, who became mobile gamers to fill dead time, now have plenty of digital options that more closely match their needs. All media companies need to learn from mobile games’ experience.

Technology

- The fall of tech major ROI: Growth will come less cheaply for the tech majors (Alphabet, Apple, Amazon, Facebook) in 2018. They will have to overspend to maintain revenue momentum so margins will be hit.

- Regulation catches up with the tech majors: Each of the tech majors is a monopoly or monopsony in their respective markets, staying one step ahead of regulation but this will change. The EU’s forced unbundling of Windows Media Player in the early 2000s triggered the end of Microsoft’s digital dominance. 2018 could see the start of a Microsoft moment for at least one of the tech majors.

Source: MIDiA Research Predictions 2018: Post-Peak Economics | Music Industry Blog

Spotify Is Said to Be Going Public in Early 2018

The streaming music giant filed a confidential registration with the S.E.C. in late December, with the intention of listing its shares in the first quarter of the year.

Source: Spotify Is Said to Be Going Public in Early 2018 – The New York Times

How Streaming Is Changing the Sound of Pop

Hit-making songwriters and producers reveal the ways they are tailoring tracks to fit a musical landscape dominated by streaming.

Source: Uncovering How Streaming Is Changing the Sound of Pop | Pitchfork

Screen Time Dollar Signs

While much focus will be on the shows themselves as the new TV season starts, we took a look at insights surrounding the advertising inventory—from how much money is spent on advertising over platforms to the commercial ratings lifts of ads beyond seven days to how marketers are leveraging branded integrations.

Source: Screen Time Dollar Signs

Apple is opening up amid privacy questions about Face ID, personal data collection

Apple released more details about the iPhone X’s Face ID feature when it published a new privacy site Wednesday, addressing some of the concerns that people have had since the face-scanning feature was announced.

The Growing Reach of Radio Among U.S. Ethnic Audiences

In aggregate, the Hispanic and black radio audience totals 74.7 million people 12 and older, up 6.25% from 70.3 million just five years ago.

Source: The Growing Reach of Radio Among U.S. Ethnic Audiences

One chart shows the rise in revenue from music streaming

After nearly two decades of declining sales, the music industry’s revenues are rebounding, thanks to streaming services.

Source: One chart shows the rise in revenue from music streaming: CHARTS – Business Insider

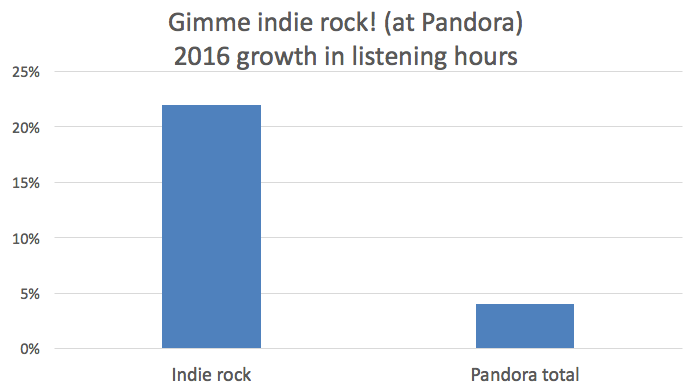

Indie Rock Is Thriving On Pandora. Does Anyone Care?

The state of indie rock? Always up for debate. The state of indie rock at Pandora? Never been better, says the music streamer’s Glenn Peoples, who took a deep dive into the data.

Spotify’s RapCaviar, the Most Influential Playlist in Music

The most influential playlist in music is Spotify’s RapCaviar, which turns mixtape rappers into megastars. And it’s all curated by one man.

Source: Spotify’s RapCaviar, the Most Influential Playlist in Music

The Music Industry Bands Together to Finally Get Paid Online

A group called the Open Music Initiative is figuring out artist payments for digital platforms.

Source: The Music Industry Bands Together to Finally Get Paid Online | WIRED

College Student Listening Habits 101

College students are in that sweet spot where music, friends and shows take priority… second to studying of course. See how this key demo discovers tunes.

Source: College Student Listening Habits 101 – The Daily Rind

Is QQ Music Worth $10 Billion?

Western appetite for the Chinese market has long been based upon accessing the 1.4 billion consumers. This has in turn impacted valuations of Chinese companies, particularly when eager western investors are involved. However, there is a growing realisation that market potential does not always translate to [performance]. Now we have Chinese tech major Tencent seeking pre-IPO investment in its music streaming service QQ Music, against a valuation of $10 billion. That is only $3 billion less than Spotify’s valuation. So, is QQ Music worth $10 billion?

Source: Is QQ Music Worth $10 Billion? | Music Industry Blog

Spotify Needs To Follow Apple’s Example To Survive

Spotify just bounded over it’s last major roadblock to going public with its new licensing agreement with Warner Music, and now it’s final hurdle is convincing the SEC that its direct listing is on the up and up. This means that the company looks to meet its goal of being listed on the New York Stock Exchange by the end of the year, but many questions about the process still remain.

Source: Spotify Needs To Follow Apple’s Example To Survive – Music 3.0 Music Industry Blog