Chris Breen

President, Towson University Investment Group

Jacob Piazza

Portfolio Manager, Towson University Investment Group

Zach Foertschbeck

Vice-President, Towson University Investment Group

THE SURVEY

The Towson University Investment Group (TUIG) conducted a research survey that asked participating students what five companies they would invest in if they had $100,000 and how confident they were in their investment knowledge on a numerical scale (1-100). We then created two hypothetical portfolios based on all of the publicly traded company votes. One portfolio for students who have not attended TUIG (General Students) and the other for students who have attended TUIG meetings (TUIG Members). The General Students Portfolio had a total of 95 holdings, whereas the TUIG Members Portfolio had 52. It is important to note that although most students who attend TUIG belong to College of Business & Economics (CBE), TUIG welcomes students from all colleges.

On 10/8/2019 hypothetical portfolios were created via Morningstar to compare key statistics to the S&P 500. Profiles were created to determine whether an aggressive, moderate, or conservative approach was present. Creating two portfolios allows us to show different investment behaviors based on educational background, as demonstrated through involvement in TUIG.

MAJOR HOLDINGS

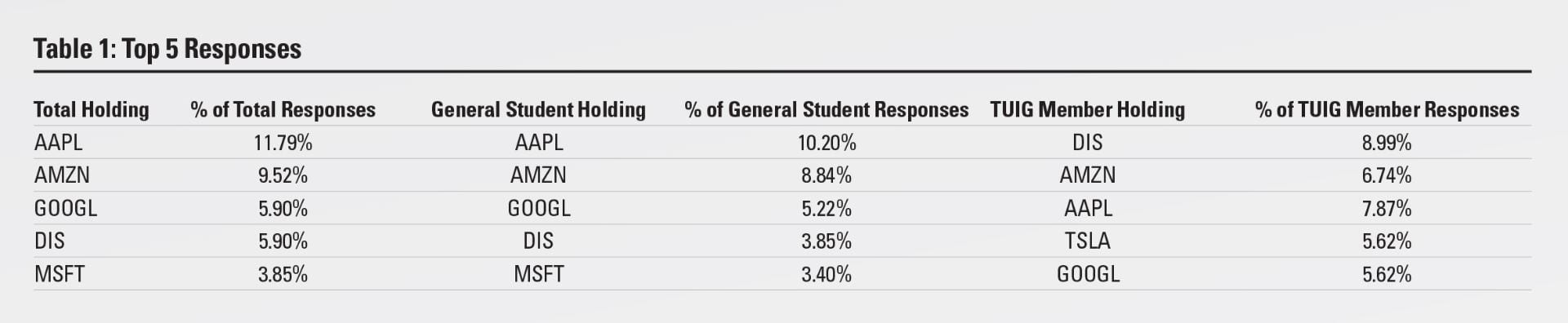

The top five holdings from the total 2019 survey responses account for 31.5% of the General Student portfolio and 29.2% of the TUIG portfolio [Tables 1]. We see similarities among these portfolios with top holdings in Amazon.com (AMZN), Apple Inc. (AAPL), Alphabet (GOOGL), and Disney (DIS). Among the top five holdings, the portfolio differences lie in Tesla (TSLA) for TUIG members and Microsoft (MSFT) for general students.

In 2018’s survey the top five holdings were APPL (10.5%), AMZN (8.45%), GOOG (5.44%), NKE (4.76%), and TSLA (2.72%). Two changes from 2018 are NKE and TSLA: Both stocks fell two rankings, slipping out of the top 5. NKE and TSLA were the 6th & 7th most frequent responses, replaced in their 2018 positions by Disney (DIS) and Microsoft (MSFT).

SECTOR ALLOCATIONS

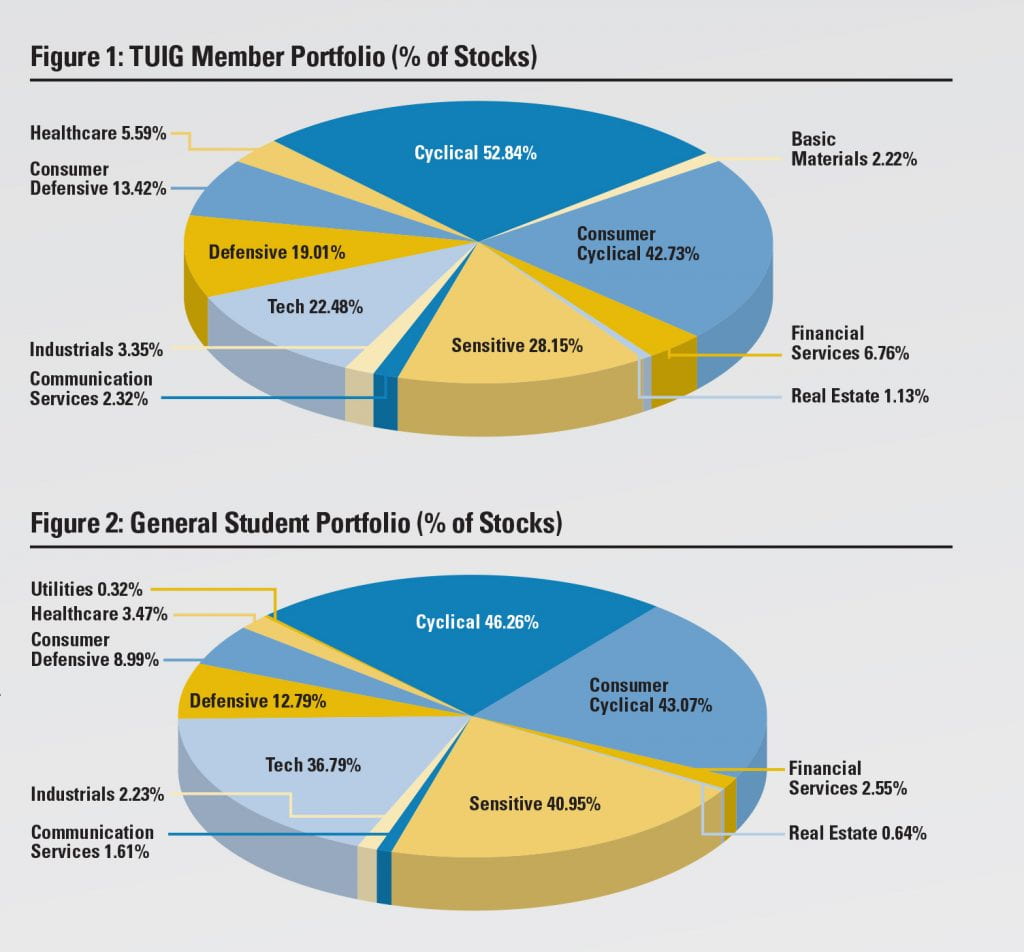

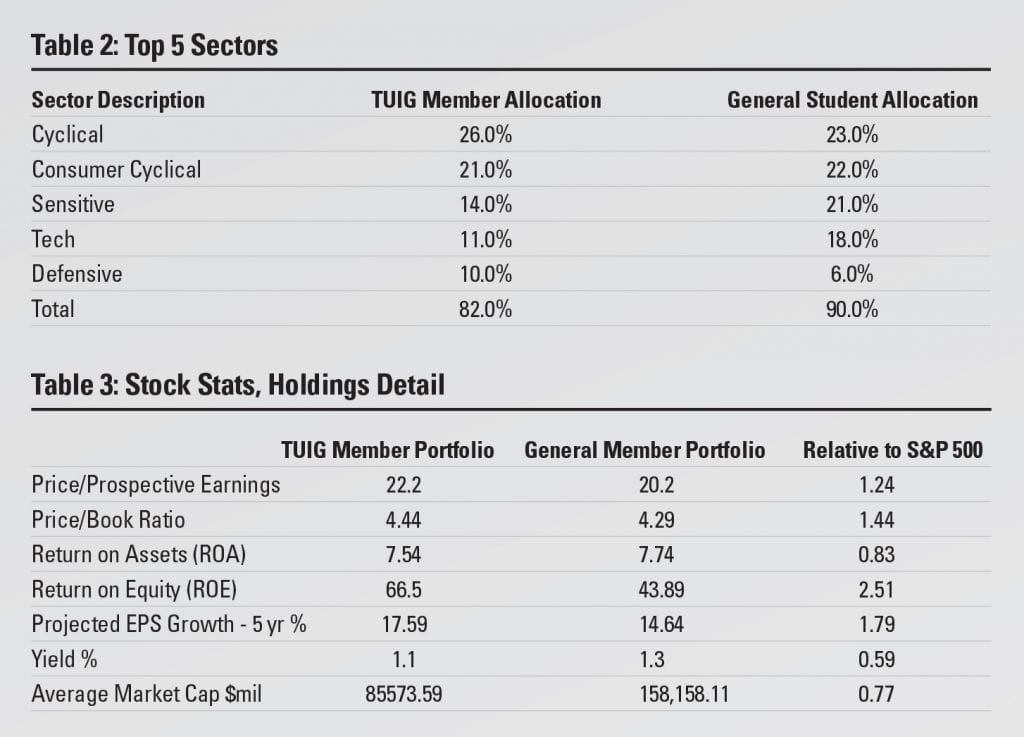

Figures 1 and 2 represent the sector allocations for both hypothetical portfolios, and Table 2 report the top 5 sectors for both the TUIG Member Portfolio and the General Student Portfolio. 90% of the General Student Portfolio is invested in the top 5 sectors, whereas TUIG members have more diversity with only 82% allocated to these 5 major sectors. The difference in diversity indicates a possible narrow scope of attention from general students, whereas TUIG members might have a larger breadth of knowledge across sectors.

Both portfolios are cyclical-heavy. The interest in cyclical investments is most likely related to the longevity of this bull market. Companies such as Amazon and Disney, who operate in the consumer cyclical sector, have seen prosperous growth over the past decade, and subsequently are very popular choices.

PORTFOLIO METRICS

Table 3 illustrates portfolio characteristics compared to the S&P 500. Both student portfolios have higher market capitalization, which is due to the large weighting of information technology stocks within the portfolios. Students in both portfolios elected to pick high growth stocks as the projected EPS growth greatly outweighed that of the S&P 500. The ROA and ROE of each portfolio is much greater than that of the S&P 500. The General Student portfolio had a lower ROE compared to the TUIG Member Portfolio because it contains a few large retail stores such as Target and Walmart.

Both portfolios have great returns so far this year, but with a slowing economy, that could change as we head to the end of the year. Students did not shy away from picking stocks that are greatly impacted by the trade war and possess the risks associated with that.

Table 3 presents insight to the respective approaches in each portfolio compared to the S&P 500. Both portfolios are fairly aggressive compared to the S&P 500. Table 3 shows higher earnings per share in both student portfolios, which reflects the profitable companies that make up the top holdings. Focusing towards aggressive growth makes both portfolios subject to higher individual stock risk than the S&P 500.

As part of our survey, we asked participants to rate their confidence on a scale from 0 – 100: 0 being least confident and 100 being most confident. On average, TUIG members (52.68) were more confident in their survey responses than general students (37.34).

OBSERVATIONS

1. Top Holdings Analysis

As previously discussed, Table 1 displays the five most popular company results from the survey along with the top five holdings for each portfolio. The top holdings for general students matched the overall top responses with slightly different weightings, whereas the TUIG members top holdings were in a different order with the exchange of Microsoft (MSFT) for Tesla (TSLA). Although TSLA has seen turbulence over the past year, some TUIG members see a valuable business and an opportunity to buy low.

2. Disney’s Double

In the 2018 survey, Disney was the 7th most popular response (2.24%); In the 2019 survey, Disney was tied for 3rd most popular response (5.89%). On July 29, 2019 DIS was trading for an all-time high at approximately $146, and it seems that Towson students would agree that Disney is highly valuable. This is not very surprising in hindsight due to the lucrative acquisitions and successful box office films that seem to never end. Disney’s acquisitions of Pixar (2006), Marvel (2009), Lucasfilm (2012), and recently 21st Century Fox, which also made DIS the majority owner of Hulu, have given the global entertainment platform a surplus of capabilities to create content with pre-existing brand equity. It seems that college students expect Disney to continue on its track of success. On November 12, 2019 Disney Plus (Disney+), a new content streaming platform owned by DIS, will begin launching in the U.S., Canada, and parts of Europe.

3. Lack of Diversification in Stock Selection

A common theme we saw in portfolios, albeit less common in the TUIG Member Portfolio, was a high concentration of large companies that college students use or see every day. Companies such as Amazon, Apple and Disney dominated the survey in terms of popularity. What was interesting was the lack of Utilities, Financial Institutions and overall business-to-business based companies. Although college students frequently deal with companies within these sectors, these companies did not appeal to them as top stock selections.

4. Recent News Drives Interest

In last year’s survey, the legalization of marijuana in Canada had an impact on student stock selections. Canopy Growth Corp. (CGC) and Tilray Inc. (TLRY) saw a 55% increase from the 2017 to the 2018 survey results. This year, however, saw the complete opposite trend as CGC and TLRY were selected by only 2% of students compared to last year’s results of 5%. The stock prices of both of these stocks have also taken a hit as CGC is down 54.37% and TLRY is down 81.19% over the past year.

5. Thematic Investment Strategy

On multiple occasions, students replied to the survey with a general sector that they think would be a good idea to invest in, but they couldn’t come up with a particular company. The sectors included medical marijuana, solar energy, retirement homes, and E-Sports. All of the industries mentioned above are rapidly growing, but with that growth comes a plethora of competition. Due to both factors, it is understandable that Towson students lack the knowledge of what companies to ultimately believe in.

CONCLUSION

Our survey resulted in a total of 100 responses from Towson University Students, each response had the opportunity to choose five companies as hypothetical investments. Between the two hypothetical portfolios, students generally had similar top holdings, however the TUIG members chose stocks that operate in a larger variation of sectors, resulting in a more diverse portfolio. We find evidence that students trend towards familiarity – or brand recognition – but lack confidence in making single-stock investment decisions. Students who attend TUIG – an extracurricular form of exposure financial investing – seem to have a larger breadth of stock familiarity.

Through our tenure as TUIG officers, we have seen first-hand that financial literacy is lacking in many young Americans. Institutions, specifically primary and secondary schools, are taking action by outsourcing the task of teaching financial literacy. One example is Ortus Academy, a Baltimore based nonprofit organization which teaches financial literacy through a simulation-based game. Members of TUIG volunteer with Ortus Academy annually, because we believe that programs like this will lead future generations to become more financially literate. Soon, the Ortus Academy will launch an online platform intended to reach more individuals.

TUIG will host its 12th annual International Market Summit in the Spring of 2020. All employers, alumni, students, and the general public are welcome to attend and hear from our panel of guest speakers discuss the current state of International Markets.

References

https://disneynews.us/important-disney-acquisitions-time-disney-history/

https://www.bloomberg.com/news/articles/2019-04-22/apple-can-relax-why-the-samsung-foldable-phone-failed

https://finance.yahoo.com/quote/CGC/chart?p=CGC

https://finance.yahoo.com/quote/TLRY/chart?p=TLRY

https://www.cnbc.com/2019/08/31/the-trade-war-has-already-cost-electronics-companies-10-billion.html