Mary J. Miller, CFA

Visiting Senior Fellow, Johns Hopkins 21st Century Cities Initiative

Ben Siegel

Executive Director, Johns Hopkins 21st Century Cities Initiative

Mac McComas

Program Coordinator, Johns Hopkins 21st Century Cities Initiative

Baltimore has the potential to be a city that is truly hospitable to small business growth, with all the economic benefits of jobs and tax revenue such growth would bring. But for new and established small businesses to thrive, the city needs a financing system with capacity to meet their needs.

Capital is certainly not the only ingredient necessary for successful business growth, but it is a critical input. If companies lack access to appropriate types of capital at critical stages of growth, they are likely to never take off and achieve scale, or even worse, to go out of business or leave Baltimore and relocate where financial support is more readily available, depriving the local economy of jobs and economic growth.

To better understand Baltimore’s financing system and the flow of capital to small businesses, the 21st Century Cities Initiative at John Hopkins University embarked on this project to answer the following questions:

- What are the sources and amounts of financial investments, both private and public, going to small businesses in Baltimore?

- How much capital is from local sources versus regional or national sources

- Where are there gaps in financing in terms of types of capital and funding amount ranges?

- Are successful businesses leaving Baltimore because they can’t access adequate growth capital?

Over the five-year period from 2011 through 2015 about $560 million per year was invested or loaned to startups and small businesses in Baltimore City (Table 1). Around 75 percent of the capital came from private sources, including banks and venture capital investors. Public sources made up the remaining 25 percent and included government subsidized and guaranteed loans, state and federal equity investments, and federal research grants to startups.

Table 1: Total Financing System by Private and Public Sources

Baltimore City Small Businesses, 2011-2015

| 2011-2015 | 2015 | ||||

| Source | # of Transactions | $ Amount | Source | # of Transactions | $ Amount |

| Private | 33,858 | $2,115,730,315 | Private | 8,221 | $493,066,301 |

| Public | 1,124 | $676,908,597 | Public | 279 | $110,704,110 |

| Total | 34,982 | $2,792,638,912 | Total | 8,500 | $603,770,411 |

| Private includes Venture Capital, IPOs, FDIC Insured Banks, and Private University and Foundation Grants. Public includes Small Business Administration 7a and 504, Export-Import Bank, Community Development Financial Institution, Federal Grants, Maryland Department Commerce, Maryland Department of Housing and Community Development, Maryland Technology Development Corporation grants (TEDCO), and Baltimore Development Corporation. |

|||||

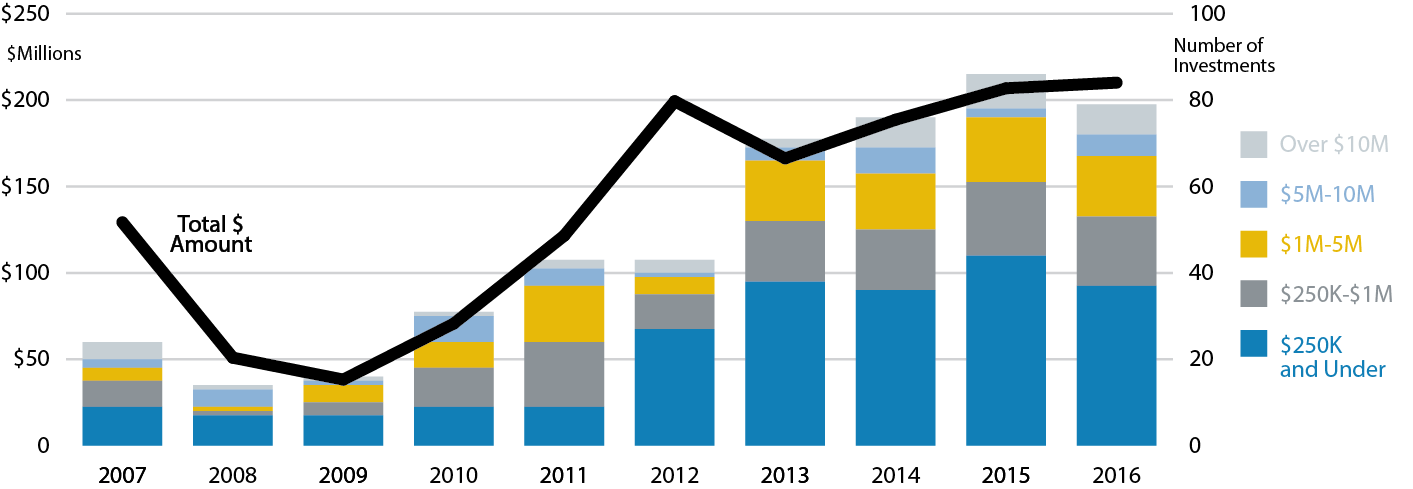

Equity investments in Baltimore’s startups and small businesses have grown significantly over the past decade and especially the past two years when venture capital and other forms of equity investment exceeded $200 million annually, compared to $50 million invested per year nine years ago. Despite this impressive growth, most equity investments are on the smaller side, less than $1 million (Figure 1); and nearly 60 percent of venture capital investors are based outside of Baltimore and Maryland (Table 2), making growing firms highly dependent on outside capital as they grow.

Figure 1: Equity Investments by Total $ Amount and # of Investments, Baltimore City Small Businesses, 2007-2016

Table 2: Origin of Venture Capital Funding From Identifiable Source

Baltimore City Small Businesses, 2007-2016

| Seed | Early | Late | All | |

| Individual Investments | 174 | 231 | 88 | 493 |

| $ of Investors from Baltimore | 29% | 16% | 14% | 21% |

| % Investors form Maryland | 28% | 25% | 18% | 21% |

| % Investors outside Maryland | 43% | 59% | 68% | 58% |

| $ Amount | $48,100,000 | $376,968,276 | $417,721,846 | $842,790,122 |

| Sources: Abell Foundation, Baltimore Angels, Camden Partners, Crunchbase, Maryland Technology Development Corporation (TEDCO), Pitchbook, and Propel. | ||||

On the lending side, the total amount of loans to small businesses has grown in recent years, but has not reached pre-recession levels, which peaked in 2007. National trends in bank consolidations have hit Baltimore especially hard. The total current small business lending activity of the consolidated banking system does not equal the sum of the parts from the early 2000s. The loss of local banks has also left a void in larger, working capital loans, as national banks are more likely to focus on credit card loans, and smaller local institutions have struggled to fill the gap. Small Business Administration (SBA) guaranteed loans and state and city loan programs can fill key gaps in providing loans to small businesses that would not otherwise qualify for bank loans and in providing larger, working capital loans. However, these programs are very small within Baltimore’s financing system.

The overall picture of Baltimore’s financing system leads to a view that it needs to grow and modernize to meet the needs of small companies in the city. The system is both fragmented and underdeveloped to provide the full continuum of capital for small business growth. It is also not a system that is easy to navigate. Based on our findings, we have developed four recommendations for strengthening and growing Baltimore’s startup and small business financing system.

Recommendation #1: Measure, track, and report

We cannot truly know the effectiveness of Baltimore’s small business financing system unless we continuously measure it and track and report on successes, challenges, and changes over time. This should include tracking individual companies and their access to capital, as well as measuring the amount of capital present in Baltimore that could potentially support small business growth.

Recommendation #2: Connect, convene, and retain

One of the biggest challenges with the current small business financing environment in Baltimore is that startups and small businesses struggle to navigate the various financing programs, and similarly, funders, investors, and lenders don’t have easy ways to connect with opportunities. We recommend a new initiative in Baltimore for showcasing growing companies at a regular convening of equity investors from Baltimore and elsewhere to make them aware of the opportunities. We also propose the creation of a navigation and concierge capacity within the city that can better connect businesses with investors and lenders.

Recommendation #3: Build more lending capacity

The data show that Baltimore’s lending capacity has shrunk and changed with bank consolidation and a shift to real estate backed loans and credit card loans as the principal forms of credit extension to small businesses in need of working capital. We need to rebuild the art and practice of small business lending in Baltimore.

To do this, public and private leaders need to work together to: 1) develop more lenders skilled in executing SBA 7a loans, 2) expand the role of Baltimore’s community development financial institutions to have a greater focus on small business lending, and 3) leverage public dollars more effectively to grow working capital lending.

Recommendation #4: Expand the range of financial institutions

There is a larger conversation to have about what is missing from the local financing system. For example, a concerted effort could be made to build corporate venture capital that could invest in local companies. There is also room for raising capital for a new Business Development Corporation or Small Business Investment Company that would provide working capital to growing companies in Baltimore. Another area to explore is whether there are opportunities to strengthen and grow some of the smaller, local banks and credit unions that are more likely to provide working capital loans.

The focus of this report has been on making what Baltimore has today work better, but our hope is that this initial exercise will unleash a discussion around infusing new capital into the system. There are many initiatives in Baltimore to support small business growth and a political leadership that is committed to growing the city’s economy. We hope this report can be a resource to every stakeholder interested in seeing Baltimore thrive.

Editor’s note: this article is a summary of a longer paper published in September 2017 by the 21st Century Cities Initiative at Johns Hopkins University. We are grateful to the authors for their research on this important topic and for including it in the Baltimore Business Review. Please access the full report here (PDF).