By Laura Braddick

On a Friday morning in April, a class of fifth graders from Harford Hills Elementary School excitedly file into the T. Rowe Price Finance Lab. Stock prices scroll by on tickers above their heads.

Despite their age, the students know what the numbers mean.

For months, they have been playing the Stock Market Game—an online simulation of global capital markets where each student selects and manages a portfolio of stocks throughout the year.

Allen Cox, Ph.D, of the Maryland Council on Economic Education (MCEE) begins the workshop by asking how their stocks are doing.

“Let me guess,” he says. “Your stocks probably did okay at first, then in December you probably lost a bunch of money?”

“Yes!” the class responds.

“Then in January and February you started making money?” added Cox.

A girl in the back raises her hand.

“Are you a fortune teller?”

“No. I’m just pretty good at predicting,” answers Cox, “because what happened to your stocks happened to my stocks.”

The girl’s hand shoots up again, “Do you have real stocks?”

“Yes, I do,” he says. “Do you think you’ll have real stocks one day?”

“Yes!”

Since 2013, nearly 2,000 K-12 students from across the state have experienced the thrill of investing and the magic of the stock market through workshops in the T. Rowe Price Finance Lab.

This number is just a fraction of the 250,000 students impacted each year by the Maryland Council on Economic Education, housed under the College of Business and Economics, through teacher development programs and competitions like the Stock Market Game.

“They actually track their portfolio and see what is happening to their money,” said Dana Livne, a fourth grade teacher at Garrison Forest School in Owings Mills, who uses the game in her class. “Even though it’s not real money, it makes it more meaningful to them than just reading about it on paper. They get more interested and engaged.”

BY THE NUMBERS1,945 K-12 students visited the lab since 2013 45 Schools 3,000 Teachers participate in MCEE professional development workshops annually 250,000 Maryland students impacted by MCEE programs annually |

Winners who generate the most returns from each school and each school district are honored at an award’s ceremony each year. The yearlong competition not only teaches how capital markets work, but also imparts the advantages of saving and investing.

All of them will have to make important economic and financial decisions after high school,” said Cox, MCEE’s assistant director of financial education. “And, sadly, many high school graduates who did not obtain the financial education that is needed make very poor choices that they later regret.”

Field trips to the finance lab reinforce these financial lessons.

“We discuss what it takes to become a millionaire and the importance of understanding how compound interest accumulated over time is the most important contributor to becoming financially independent later in life,” he said. “We also discuss what to look for when researching stocks and other investments that are available in the Stock Market Game.”

“We discuss what it takes to become a millionaire and the importance of understanding how compound interest accumulated over time is the most important contributor to becoming financially independent later in life,” he said. “We also discuss what to look for when researching stocks and other investments that are available in the Stock Market Game.”

Students play The Millionaire Game, where they are given true or false statements about millionaires based on the book, The Millionaire Next Door, by Thomas Stanley.

“They’re surprised to discover that many millionaires lead pretty ordinary lives; do not overwhelmingly buy expensive cars; are mostly college graduates (with some very famous exceptions like Steve Jobs and Bill Gates); often work long hours; and mostly did not inherit their money,” said Cox.

Concepts like compound interest and the intricacies of investing in the stock market may seem like complex topics for young children. But educators like Amy Cargiulo, a teacher at Pointers Run Elementary School in Clarksville, Maryland who’s been bringing classes to the lab for seven years, say it sticks.

“These kids are only in fifth grade, but it really makes an impression,” said Cargiulo. “Dr. Cox breaks it down to a level that makes the big ideas clearer. Learning from an expert on ways to build good financial habits and stay out of debt—these things are going to be the cornerstones for their financial future. These programs are really laying the foundation for a lot of them. It opens up their eyes to good spending habits and good saving habits.”

“I’ve had kids come back as high schoolers and beyond and say they learned so much from the Stock Market Game,” said Cargiulo.

In addition to building a foundation for solid, lifelong financial skills and habits with the Stock Market Game, field trips to the finance lab expose kids to a college campus environment and a college learning experience.

“I’d be lying if I didn’t say that the cafeteria is their favorite part,” laughed Cargiulo.

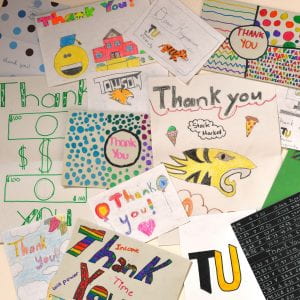

In thank-you notes to Cox, the kids often write how they loved TU so much, they want to go there for college.

“It makes them feel like they’re special,” says Livne. “They think, ‘We’re learning about things that college students know.’ And it’s just exciting having a lesson in the lab on a college campus. It’s a big deal to them.”

Empowering Maryland Teachers and Students for More than 60 Years

Empowering Maryland Teachers and Students for More than 60 Years

Founded in 1953, the mission of The Maryland Council on Economic Education is to assure that Maryland’s school children leave high school equipped with the economic knowledge and decision-making skills they will need to make informed, rational decisions as consumers, workers, citizens, savers, investors and participants in the global economy.

Working through the education system to increase the quantity and improve the quality of economic and financial instruction provided in Maryland schools, MCEE provides free teacher workshops, individualized curriculum development, lesson plans, seminars for adults and community groups, as well as the Maryland-D.C. stock market game, a poster contest for students in grades 1 through 8 and the Maryland Economics Challenge.